ESG

The perceived ESG performance. Drilled-down into 26 dimensions. Updated in real-time

Dynamic ESG tracking

An alternative to static ESG’s made by the companies is Atlastic’s real-time perception approach, using extremely scalable natural language processing and AI’s to analyze billions of news articles to detect, categorize and benchmark the perceived ESG performance, drilled-down into 26 dimensions. This for every single stock market listed company.

8.2 million sources, 100 languages

Investors are increasingly applying the Environmental, Social and Governance factors as part of their analysis process to identify material risks and growth opportunities. We monitor, analyze and summarize more than 8,2 million news sources, with the AI power of understanding more than 100 languages, to pinpoint the stakeholder perception of how companies perform in regards to ESG.

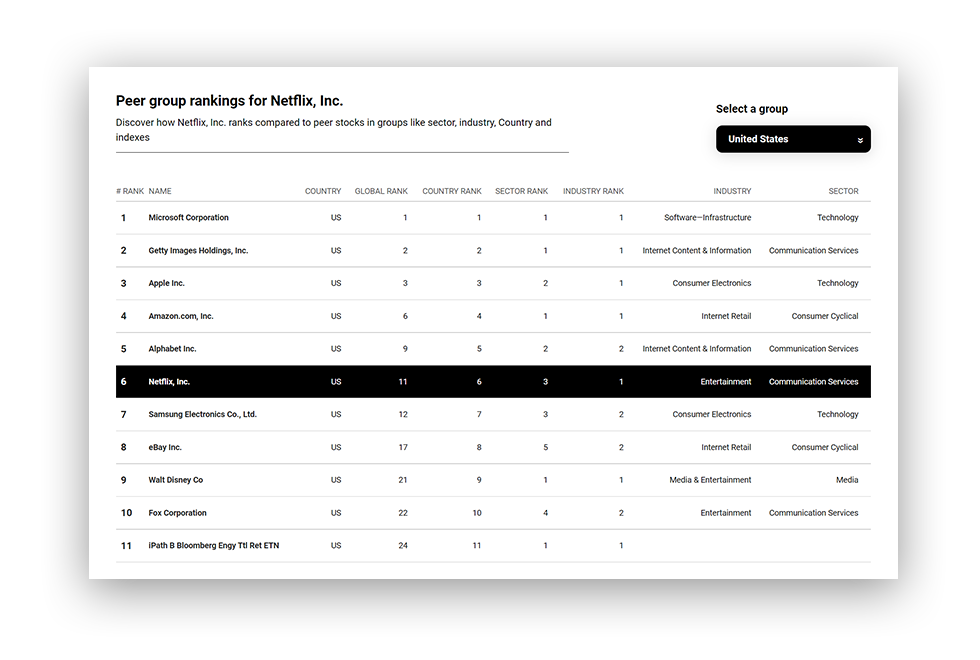

Peer group benchmarks to evaluate

Who are doing better than the rest when it comes down to the underlying ESG dimensions? With Atlastic, this information is always available, no matter if the preferred benchmark is peer group, country specific, similar market capitalization or something else.

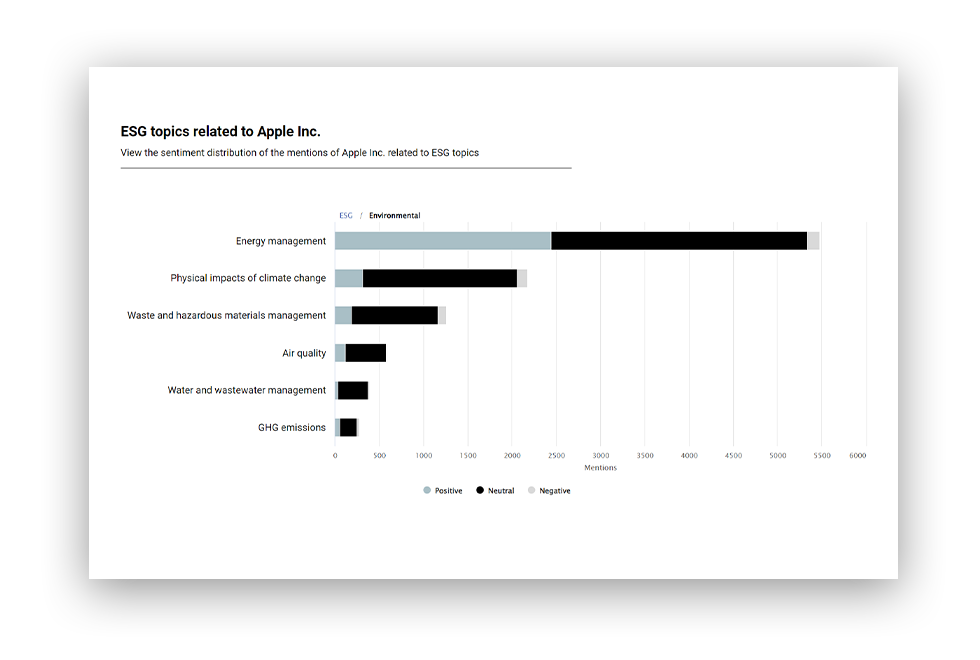

Environmental

The ‘E’ in ESG is drilled down into six dimensions, inc. ‘waste and hazardous materials management’ and ‘air quality’, which are updated live.

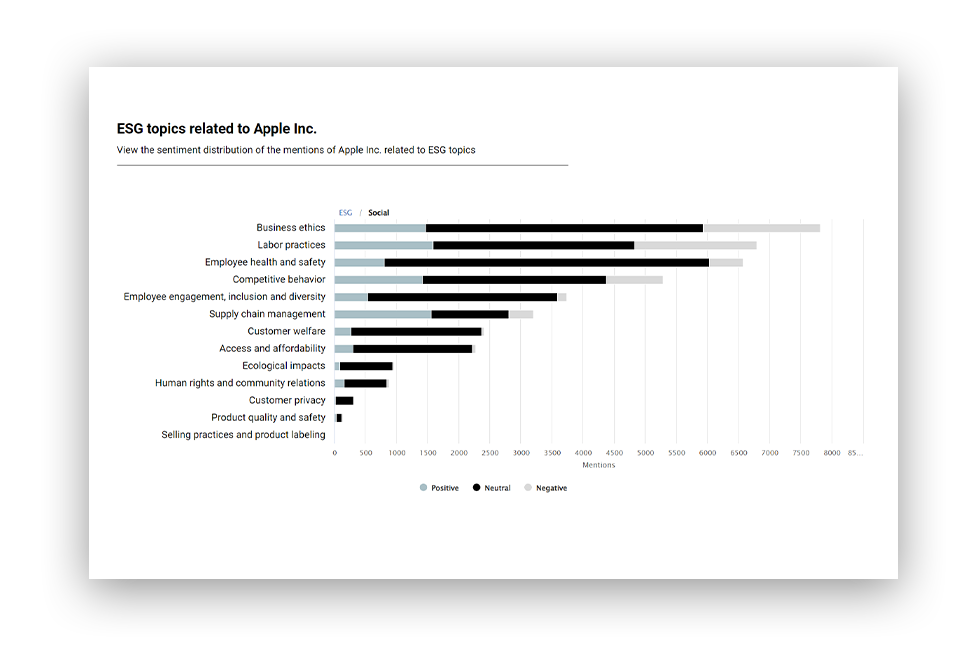

Social

The ‘S’ in ESG is drilled down into 12 dimensions incl. ‘business ethics’ and ‘human rights and community relations’, which are – also – updated live.

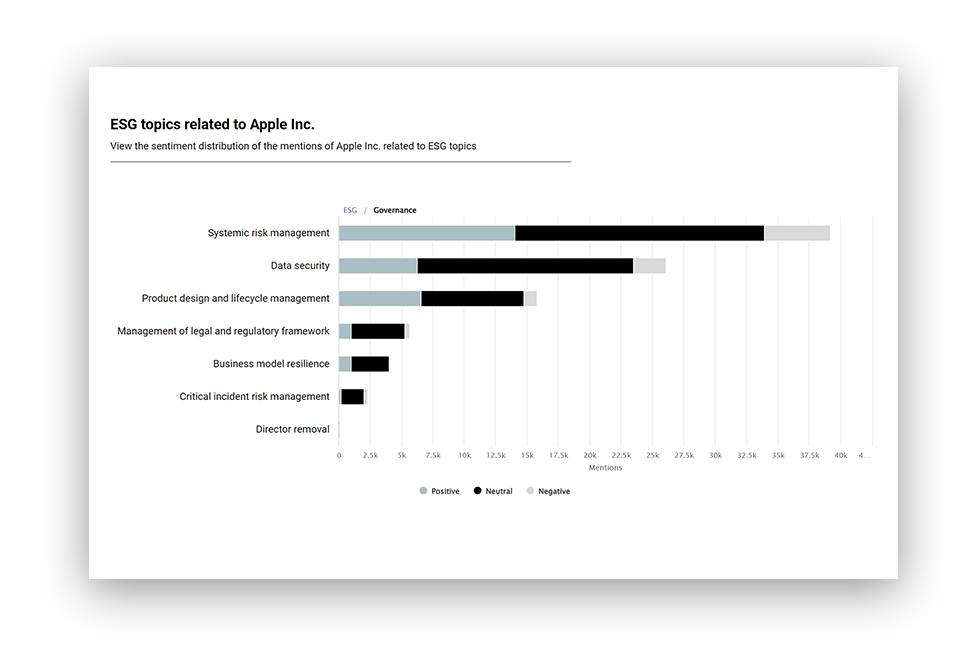

Governance

The ‘G’ in ESG is drilled down into seven dimensions incl. ‘systemic risk management’ and ‘data security’, which are – that’s right – updated live.

Get a free demo

Experience how the unique Atlastic.ai combination of structured global data from millions of sources plus automation and enrichments by powerful AI, can provide you with the relevant insights from the outside world. This to help you make better-informed decisions, avoid risks and create more value.