Trust value tracking

Atlastic turns live quantification of public perception into alpha

Win with Corporate Trust Made Measurable

Corporate trust is no longer intangible – it shapes capital flows, credit spreads, and long-term valuations. Yet until now, it has been difficult to observe and quantify in real time. Traditional reputation data is anecdotal, survey-based, or updated too slowly to matter for investment and risk decisions.

Atlastic makes trust measurable by processing millions of verified global media sources and translating them into structured, time-series data. Each trust signal is linked to over 50,000 listed companies, providing a forward-looking variable investors and risk teams can model, monitor, and act on.

Relevance of Trust in Equity Value

Intangibles now dominate market capitalization – and trust, as the core of goodwill, is a critical driver of equity value. Yet it remains poorly measured despite being highly exposed to sudden shocks.

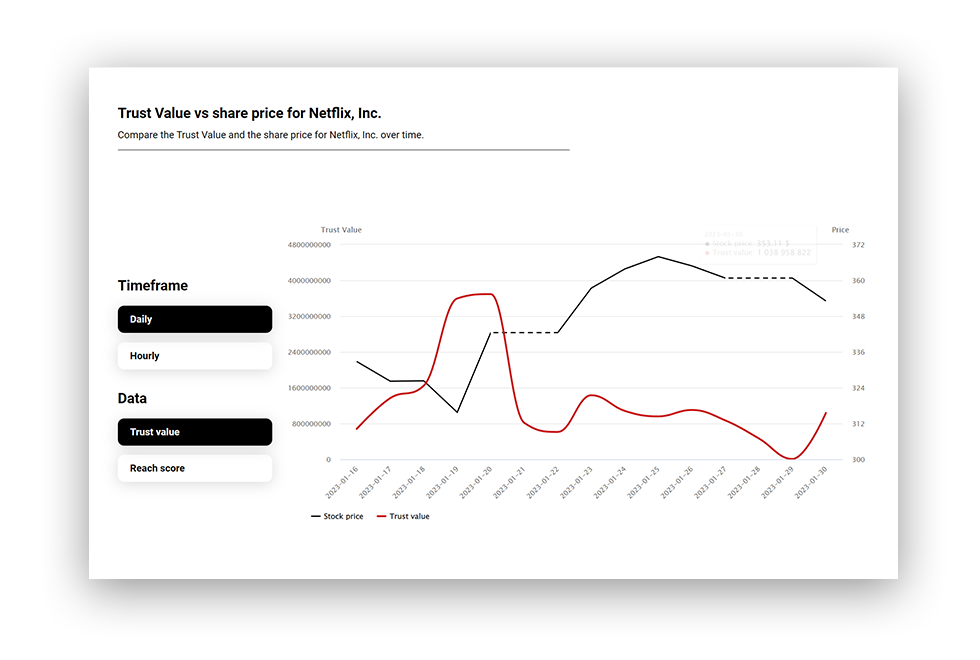

Tracking these intangibles early is essential. Trust erosion often precedes value destruction: governance controversies, leadership scandals, or ESG breaches frequently wipe out billions before financial metrics adjust. Conversely, high-trust companies attract capital at lower costs, sustain premium valuations, and show lower volatility.

Narratives drive this dynamic. Public confidence shapes how quickly negative news escalates into regulatory action, litigation, or customer backlash. But current “trust metrics” are lagging, opaque, and incomplete – failing to give investors or risk managers usable foresight.

Atlastic makes the intangible measurable by transforming global media and public discourse into structured, real-time trust data. This gives investors and risk teams forward-looking signals to anticipate equity impacts, protect portfolio value, and capture upside where trust momentum is building.

Trust Value: The Dataset Difference

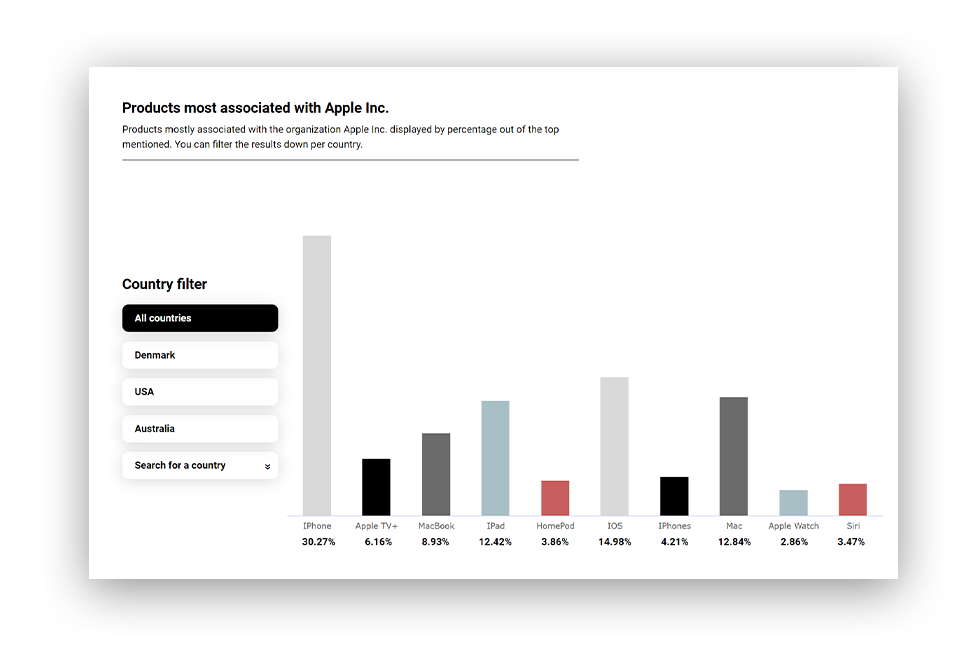

Atlastic’s Trust Value dataset captures how companies are portrayed and perceived globally:

- Trust Value – a real-time index of public confidence, derived from media narratives and weighted by source influence.

- Trust Momentum – measures the speed and direction of changes in perceived trust.

- Trust Volatility – quantifies instability in public confidence, often preceding market volatility.

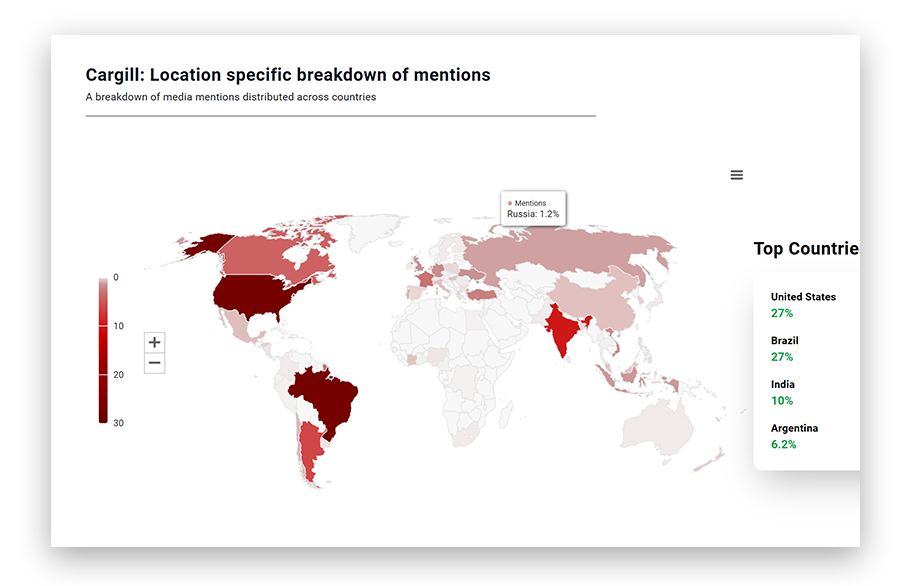

- ESG Perception – tracks how environmental, social, and governance narratives shape trust levels.

- Leadership Trust – isolates perception around CEOs and top management.

All data is point-in-time, survivorship-bias free, and comprehensive, with 5+ years of history across 50,000+ public companies, 250+ jurisdictions, and 100+ languages, updated continuously from over 4M new articles per day.

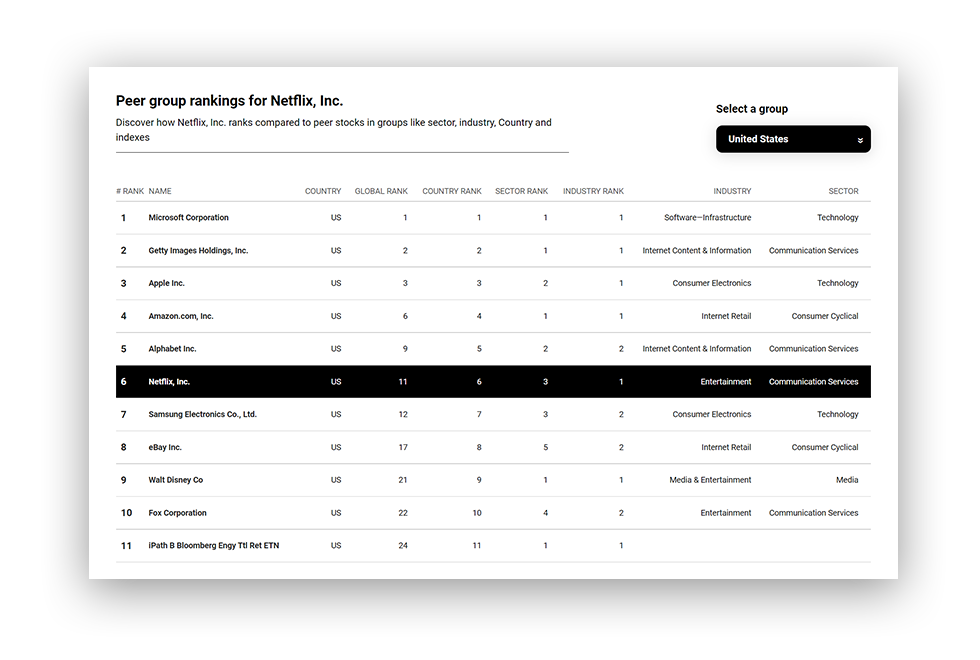

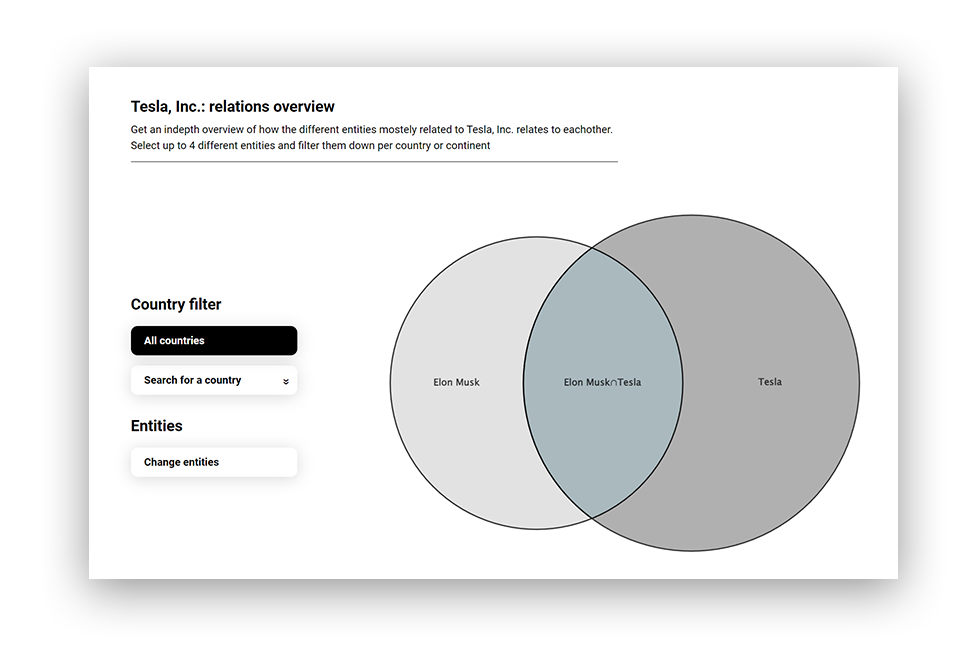

The dataset enables investors and risk teams to monitor reputation risk, build perception-based factors, run scenario analyses, and benchmark trust across peers, sectors, and regions—all in a structured, model-ready format.

Delivery and Integration

Atlastic delivers trust data in the formats you need:

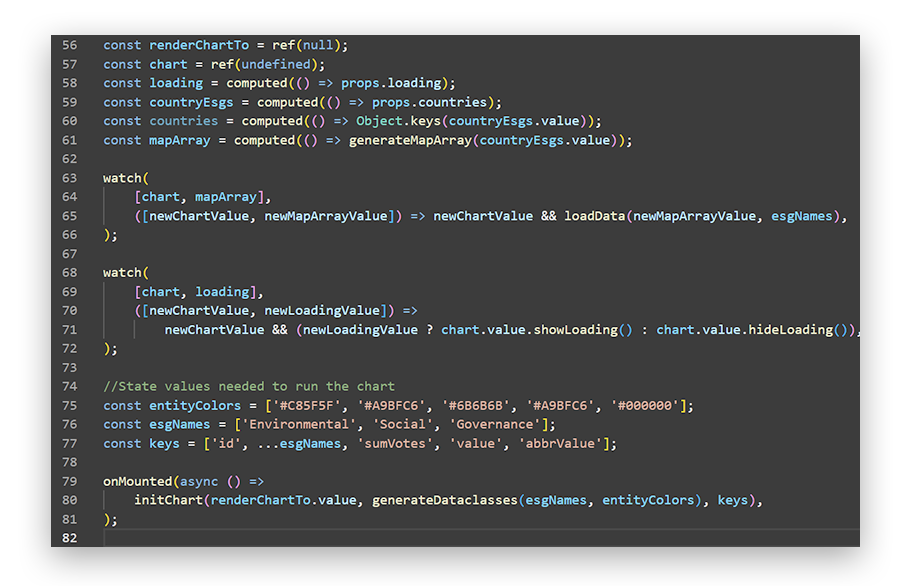

- API & Custom Feeds – standardized schema for seamless use in cross-sectional and time-series models.

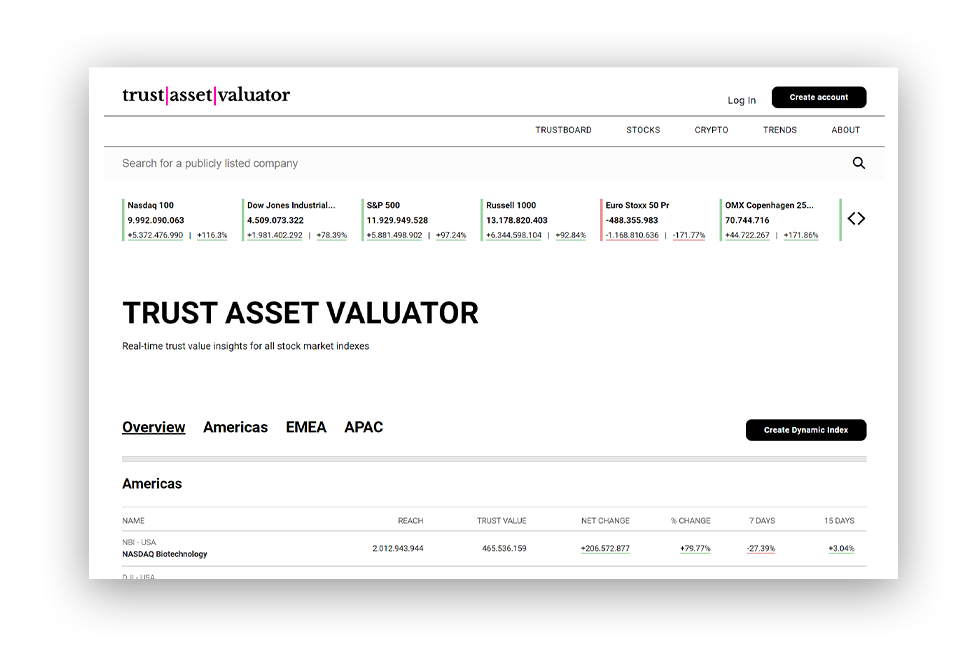

- Real-Time Dashboards – intuitive tools for non-quant teams to monitor portfolio-wide trust dynamics.

- Historical Archives – point-in-time datasets for factor testing, backtesting, and stress-testing scenarios.

This structured, quant-ready dataset makes trust an observable, measurable variable in investment and risk processes – providing early insight into reputational threats and long-term value creation.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.