Quantitative Trading

Atlastic delivers perception data as alpha signals for quant models

Perception as Alpha Signals – for the Win

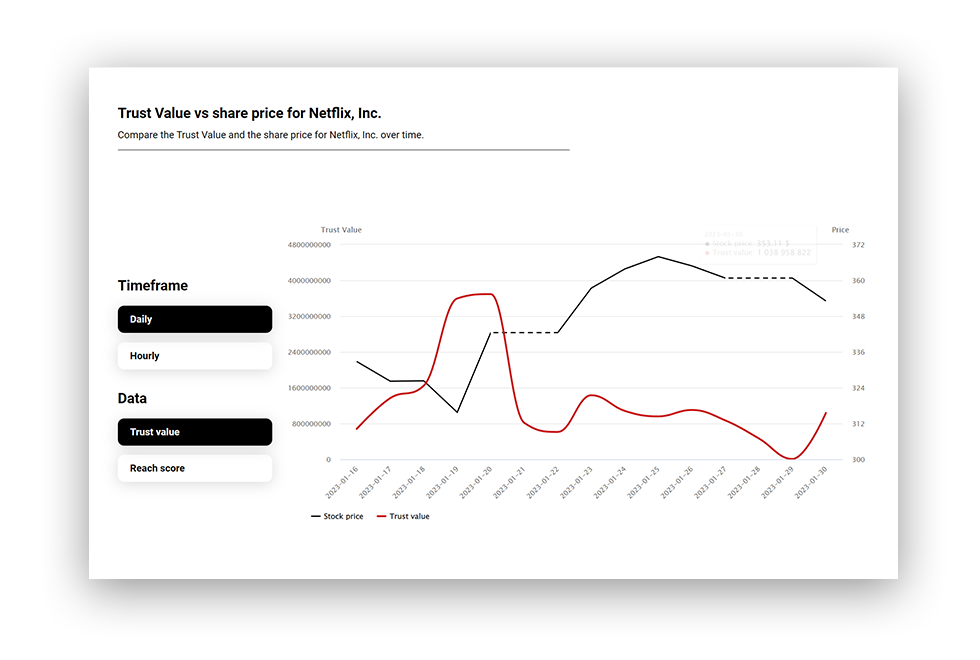

Markets react to perception before fundamentals adjust. Investor behavior, risk appetite, and capital flows are shaped by trust, narrative momentum, and controversy build-up long before price and volume reflect these forces.

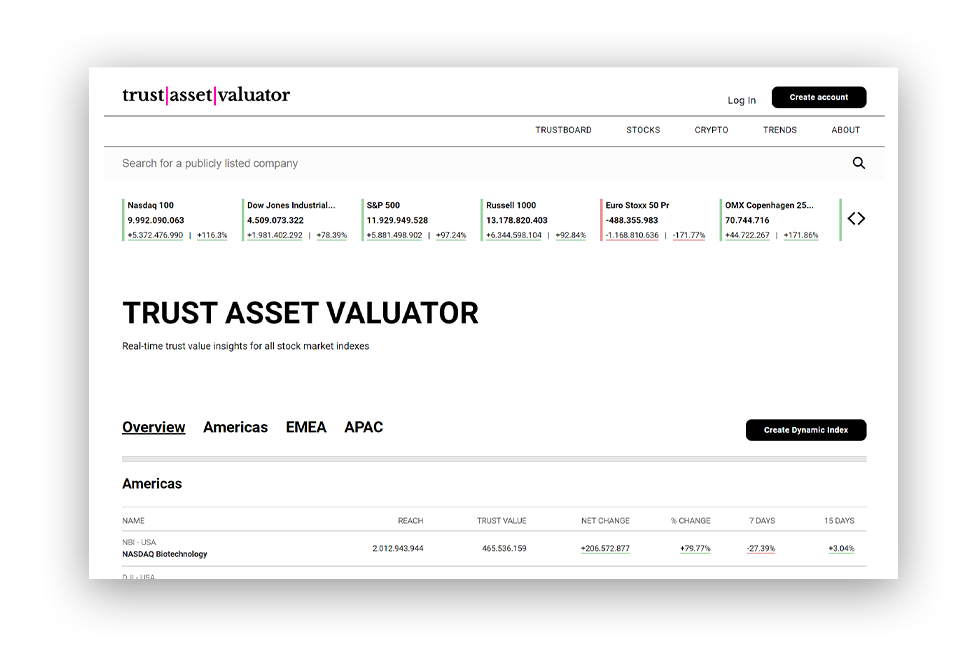

Atlastic delivers a structured, high-resolution dataset on how companies are portrayed and perceived across millions of global media sources. Perception-based data quantifies sentiment, trust, attention, and controversy as measurable, time-series variables mapped to over 50,000 listed companies worldwide – updated in real time.

By processing 8.2M verified sources in 100+ languages and linking every signal directly to a ticker, Atlastic enables quant researchers to uncover predictive factors, expand models, and integrate market psychology as a forward-looking input to systematic strategies.

This is not keyword scoring. It is structured perception intelligence – purpose-built for alpha discovery.

Relevance of Perception in Quant Research

Empirical studies show that shifts in sentiment and media attention can predict future returns, volatility, and liquidity. Yet perception remains underused in quantitative research because traditional datasets are:

- Sparse and lagging: surveys are infrequent and narrow in scope.

- Noisy and shallow: keyword sentiment misses context and narrative framing.

- Difficult to scale: unstructured text resists clean integration with models.

As a result, many strategies overlook the informational layer where market expectations are formed. Perception is inherently forward-looking: trust builds before momentum, controversy emerges before drawdowns, and stakeholder sentiment shifts before leadership or policy changes drive repricing.

Atlastic structures this perception layer into clean, model-ready variables, enabling quants to:

Atlastic captures this layer in structured form, making it possible to:

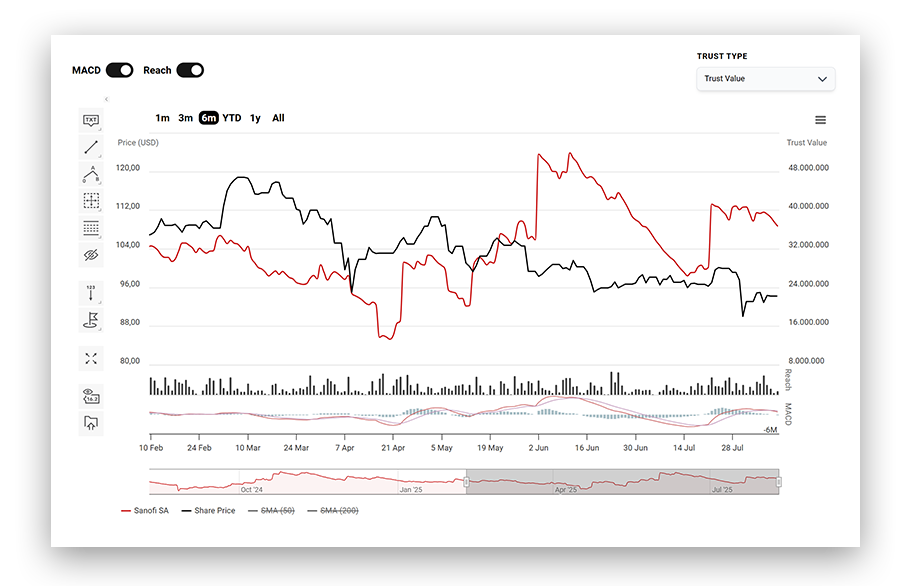

- Detect narrative build-up ahead of volatility events.

- Quantify stakeholder trust momentum as a leading indicator.

- Enhance multi-factor models with perception-driven inputs.

- Identify early controversy signals that anticipate repricing.

The Data Difference for Predictive Edge

Atlastic ingests 4M+ articles daily from a curated universe of 8.2M verified sources across 250 jurisdictions – covering financial media, industry publications, NGO reports, regulatory filings, and local news. Each signal is transformed into structured, model-ready data through:

- Contextual Scoring – sentiment captured in full narrative context, not isolated keywords.

- Influence Weighting – sources ranked by credibility and market-shaping potential.

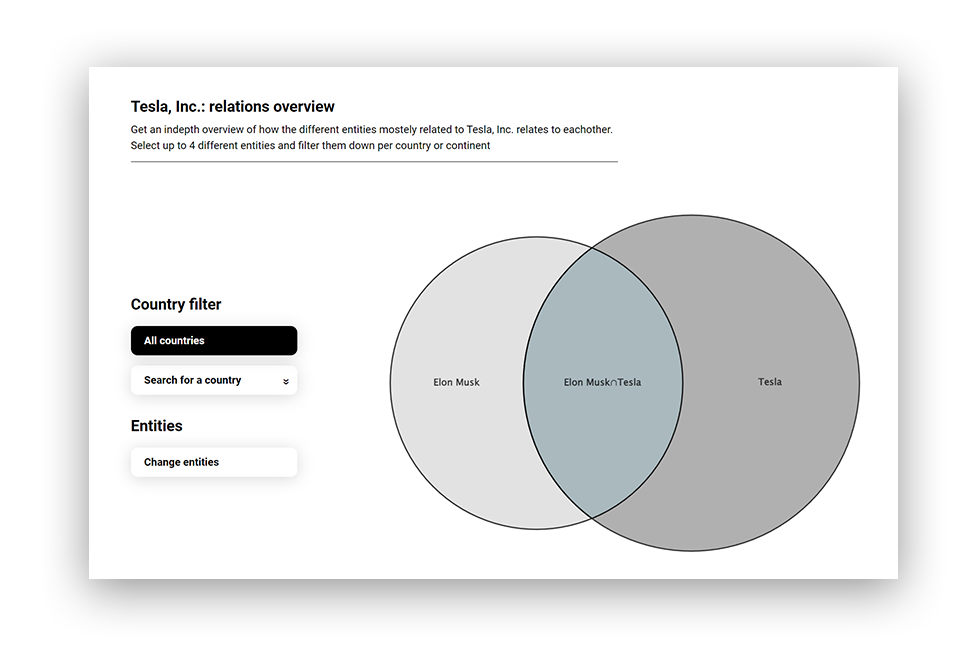

- Stakeholder Mapping – signals connected to companies, sectors, and decision-makers.

- Time Awareness – shifts timestamped for both short-term reactions and long-horizon modeling.

- Entity Linking – mapped to tickers, sectors, and geographies for cross-sectional analysis.

Atlastic also provides 5+ years of point-in-time history, enabling robust backtesting and survivorship-bias-free research.

This structured, machine-readable dataset enables:

- Signal Discovery – correlation analysis and hypothesis testing across vast narrative data.

- Factor Construction – build standalone perception factors or overlay them on value, momentum, and quality models.

- Risk Diagnostics – track trust erosion, controversy build-up, and leadership sentiment as leading volatility drivers.

- Event Anticipation – identify early signals of earnings surprises, regulatory actions, and reputational shocks

Precision Data Delivery for Quant Research

Atlastic delivers clean, scalable datasets purpose-built for systematic strategies and quant research workflows:

- API & Custom Feeds – standardized schema across entities, sectors, and regions.

- Real-Time Streaming – configurable thresholds for monitoring and alerts.

- Point-in-Time Archives – robust backtesting and factor validation without survivorship bias.

- Seamless Integration – ready for Python, R, and cloud-based analytics environments.

From targeted sector coverage and event-specific backfills to full-universe data, Atlastic provides structured perception signals designed for proprietary model engineering.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.