For Perceived ESG

Atlastic transforms ESG perception into measurable insights for better decisions

Track Perceived ESG for the Win

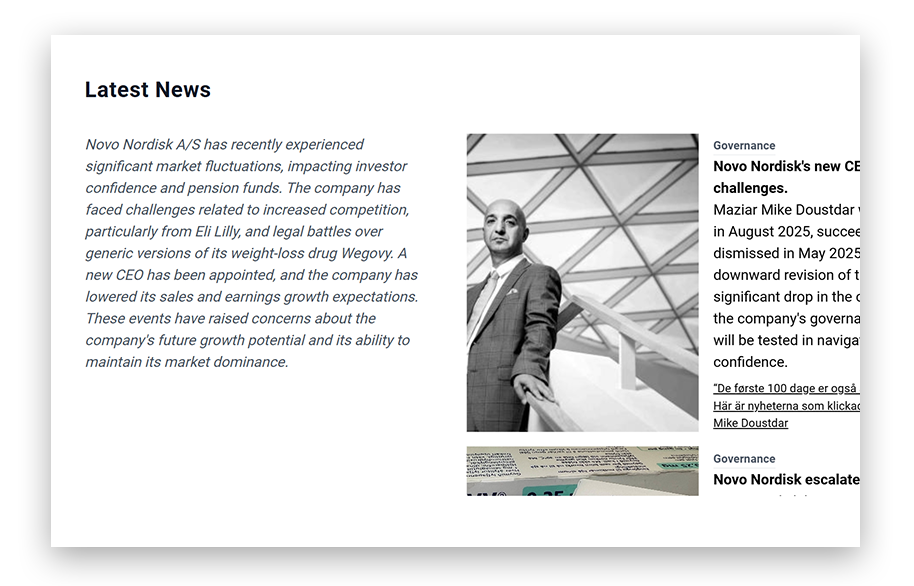

ESG performance is no longer defined by reported metrics alone – stakeholders, regulators, and investors continuously shape perception through media coverage, social discourse, and advocacy reports. Atlastic captures this narrative layer in real time, transforming it into structured, actionable data. With the ability to track perceived ESG risks and opportunities as they emerge, you can anticipate their impact on reputation, valuation, and risk exposure – before they become material.

Relevance in ESG Risk and Performance

ESG ratings and disclosures are inherently lagging indicators – built on surveys, self-reporting, or delayed filings. They miss the live perception of ESG performance, where shifts in stakeholder trust and public attention can spark immediate market reactions, capital reallocation, or regulatory scrutiny.

In today’s media-driven environment, attention is the earliest signal of change. It mirrors stakeholder values, beliefs, and expectations on environmental, social, and governance issues long before formal ratings are updated. Atlastic delivers a continuous, independent view of perceived ESG performance, giving you a more relevant basis for risk management, stewardship, and investment decisions.

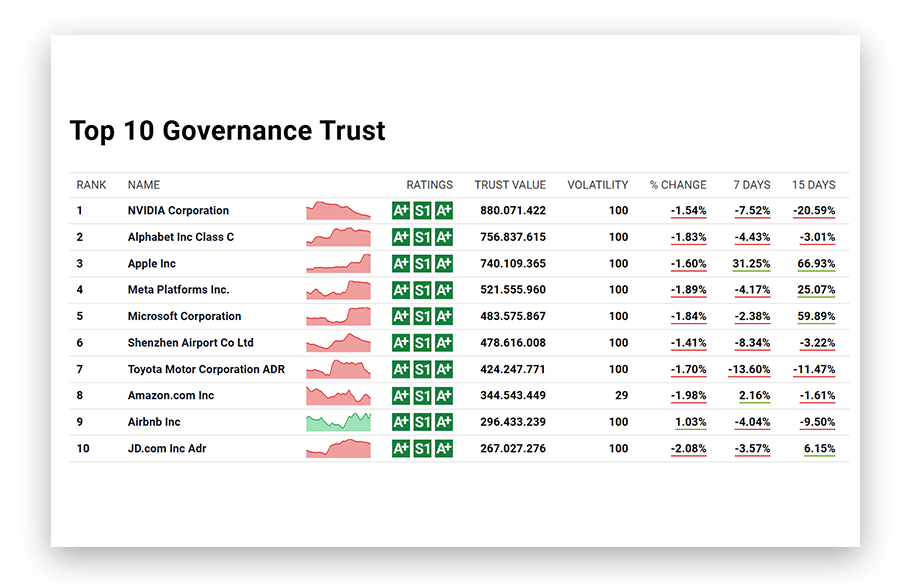

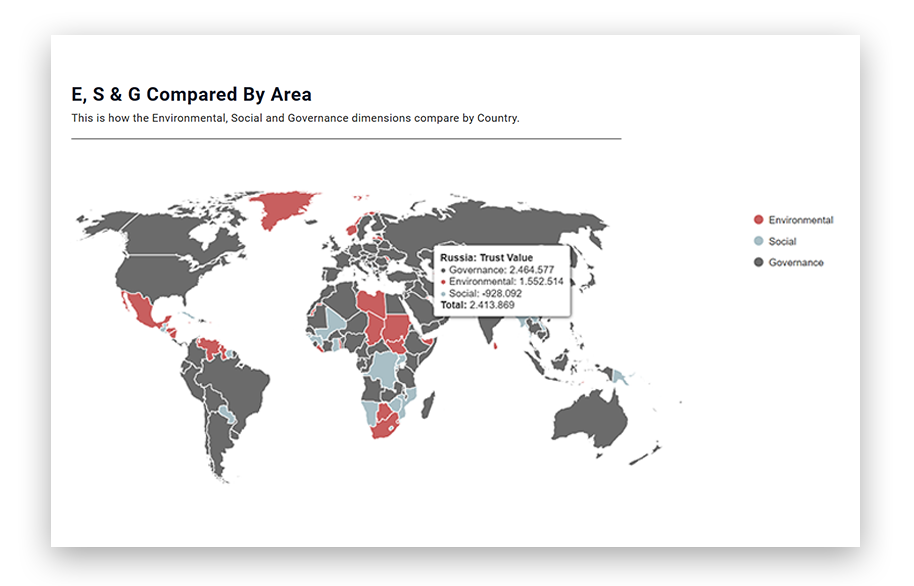

A Methodology Beyond Static ESG Ratings

Atlastic goes further than traditional ESG ratings by tracking how ESG narratives build and evolve globally in real time. Our methodology processes over 4 million articles each day from 8.2 million verified sources across 100+ languages and 250+ jurisdictions. By combining financial news, NGO reports, local journalism, regulatory updates, and industry publications, Atlastic maps the live ESG conversation around more than 50,000 listed companies – and all the privately owned companies you need. This gives you a leading indicator of ESG risk and opportunity, complementing or challenging traditional scores with a real-time, outside-in perspective that turns perception into actionable intelligence.

What sets Atlastic apart:

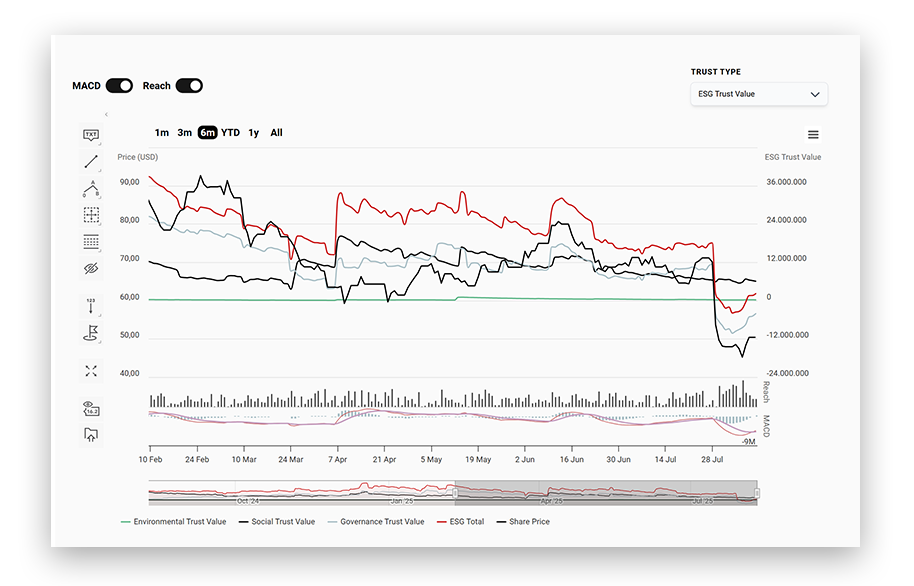

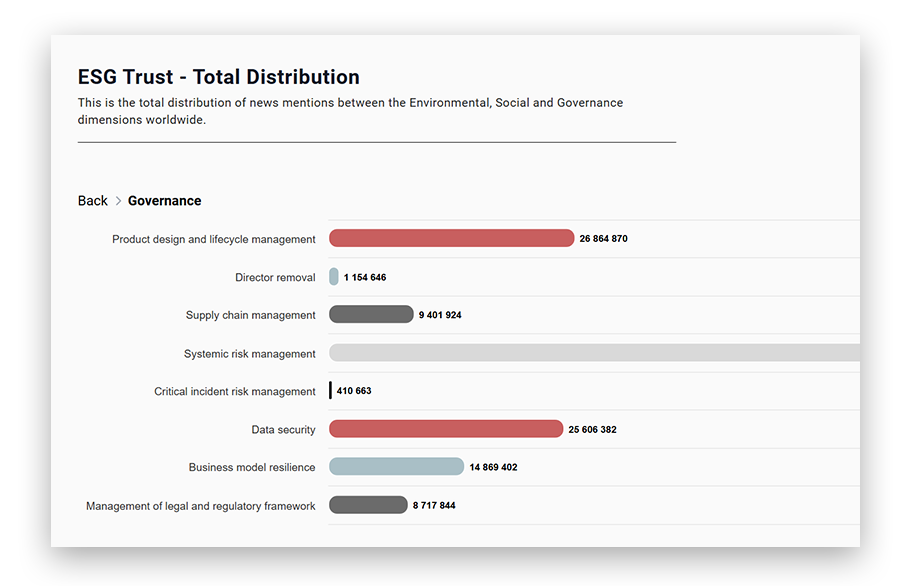

- Narrative ESG scoring: Track perception momentum for E, S, and G dimensions separately and combined

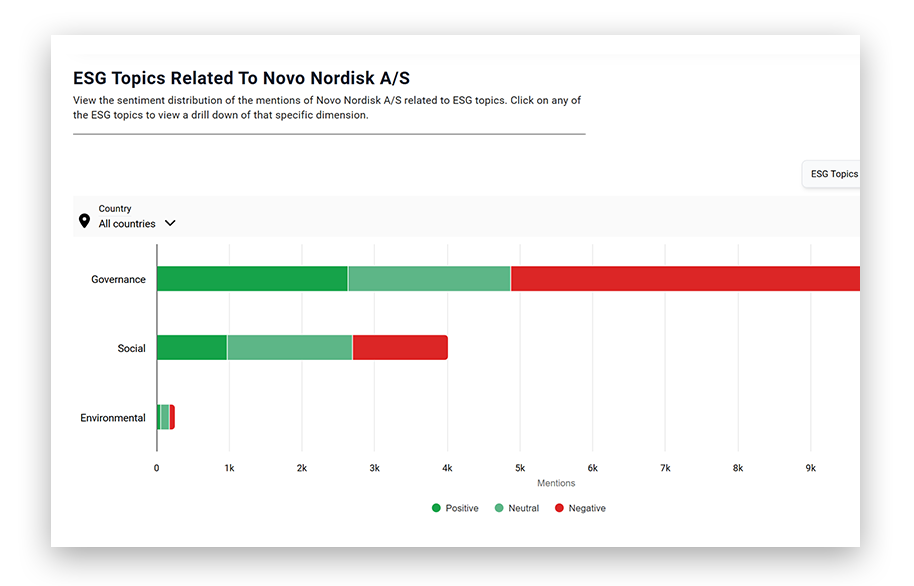

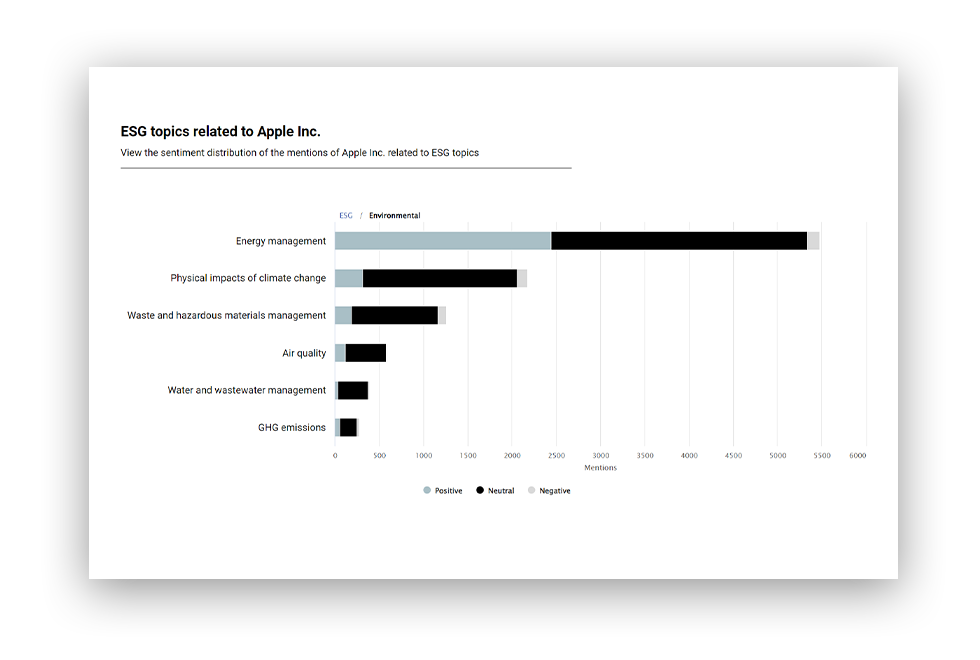

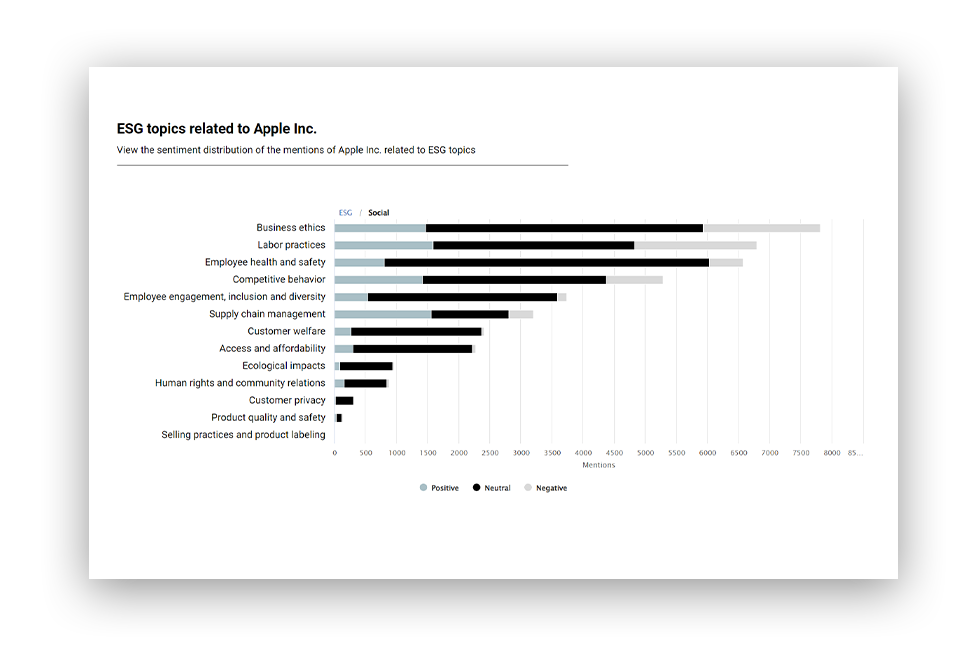

- Issue-level granularity: Drill into specific controversies, climate commitments, labor practices, or governance disputes

- Context-aware analysis: Capture framing and sentiment severity, not just frequency of mentions

- Influence weighting: Differentiate between high-impact sources (regulators, NGOs, tier-one media) and low-level noise

- Visibility and impact split: Measure both how much attention an ESG issue receives and whether it strengthens or erodes trust

- Bias correction: Adjust for regional or linguistic coverage skew for a balanced global view

- Historical datasets: Enable backtesting of ESG

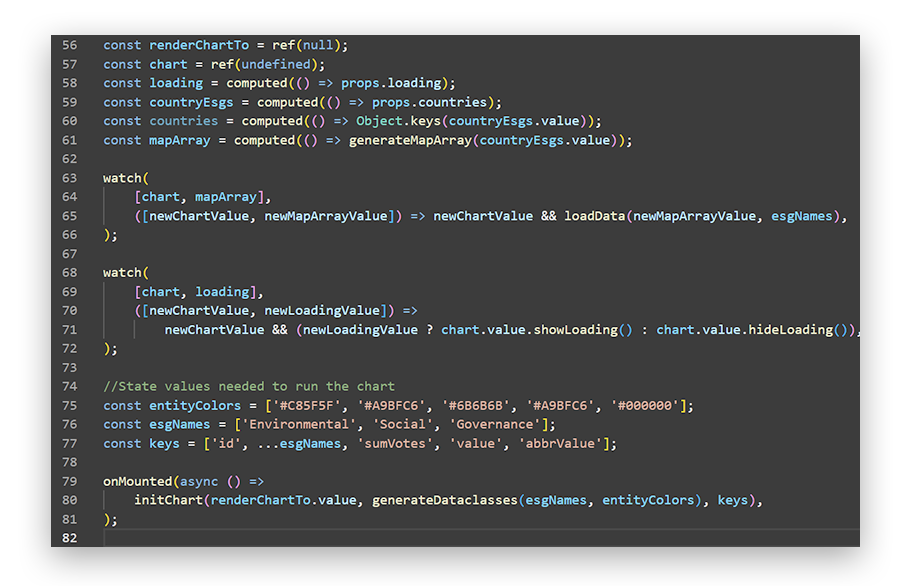

Seamless ESG Data Delivery

Atlastic delivers structured perception data through API or tailored feeds – ready to integrate directly into your ESG dashboards, risk models, and stewardship frameworks. Monitor single companies, portfolios, or entire sectors with continuous updates and configurable alerts. For instant access without integration, Atlastic also offers an easy-to-use Perception Platform – making advanced ESG insights accessible to all teams. Move beyond reported ESG metrics and understand how your holdings are truly perceived – globally, live, and at scale.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.