For investors, trust isn’t just a soft metric – it’s a forward-looking signal. Corporate reputation, as reflected in media sentiment, increasingly influences valuation, risk exposure, and long-term performance. Atlastic.ai’s Trust Value rankings provide a real-time view of how listed companies are perceived globally, based on millions of verified news signals across 100+ languages.

In this edition of Atlastic.ai Weekly, we turn our focus to the automotive sector, with a special lens on electric vehicle (EV) manufacturers. Who leads in trust, who is losing ground, and how are public narratives shaping investor sentiment around some of the most-watched companies in the world?

EV Trust Rankings: Toyota Leads, Tesla Slips, Xpeng Wavers

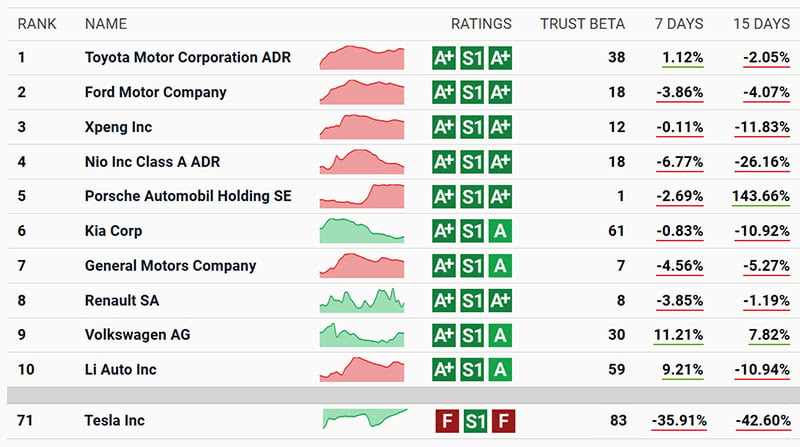

Atlastic.ai’s latest trust rankings for publicly listed car manufacturers reveal a sharp contrast between global leader Toyota and the faltering Tesla.

Toyota holds the number one position with the highest Trust Value, supported by a consistently strong media reputation, moderate volatility, and positive short-term momentum. Its 7-day trend is up by 3.99 percent, and despite a slight 15-day dip of 2.51 percent, Toyota remains remarkably stable with a Trust Beta of just 35. It continues to lead as the world’s most trusted automotive brand.

Tesla, in stark contrast, ranks last. It currently holds a deeply negative Trust Value of minus 338 million, with sentiment dropping over 30 percent in the past week and 14.84 percent over the past 15 days. With the highest Trust Beta in the ranking at 84, Tesla is the most volatile brand in the sector. Even minor news events can trigger large trust swings. Despite its visibility and dominant role in the EV market, Tesla now trails behind both legacy automakers and new challengers in reputational strength.

Volkswagen, positioned tenth, is showing encouraging signs of recovery. While its overall Trust Value is lower than top-tier brands, it gained 7.26 percent over the past week and 3.15 percent over 15 days. This suggests growing investor and media confidence, likely tied to progress in its EV transformation and a more balanced narrative.

Xpeng, the highest-ranked Chinese carmaker at number three, holds a solid Trust Value just below 1 billion. However, momentum has stalled. Over the past 15 days, trust has dropped by nearly 10 percent, and the short-term trend has flattened. Xpeng still ranks among the top performers, but the fading momentum reflects heightened geopolitical scrutiny and a more cautious outlook on Chinese tech stocks.

In other words, Toyota remains strong and stable, Volkswagen is on the rebound, Xpeng is losing momentum, and Tesla continues its sharp reputational decline.

Tesla Falters, Xpeng Rises: A Shift in EV Trust

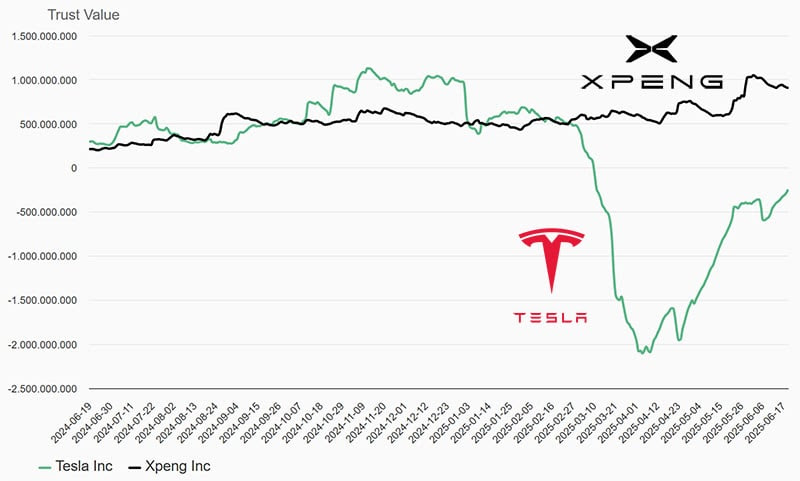

Let’s deep-dive a bit into the EV segment: Trust Value trends over the past year highlight diverging reputational paths for Tesla and Xpeng. While Xpeng maintained stable and positive media sentiment through most of 2024, Tesla entered 2025 with a steep decline. By April, Tesla’s Trust Value had plummeted to nearly minus 2.2 billion before staging a partial recovery.

Xpeng’s Trust Value ranged consistently between 500 million and 1 billion. This reflects both the strength of its own brand and a broader media shift: the era when Chinese automakers were met with default scepticism is over. Chinese EV brands are now seen as credible, competitive, and increasingly innovative players on the global stage.

Tesla’s trust collapse has been driven by overlapping narratives. Coverage of Elon Musk’s polarizing public behavior, increased regulatory scrutiny of Autopilot and Full Self-Driving systems, repeated product recalls, and growing criticism of labor and ESG practices have combined to erode the company’s standing. Its once-dominant position in the EV conversation is now under pressure from more focused and less volatile challengers like Xpeng.

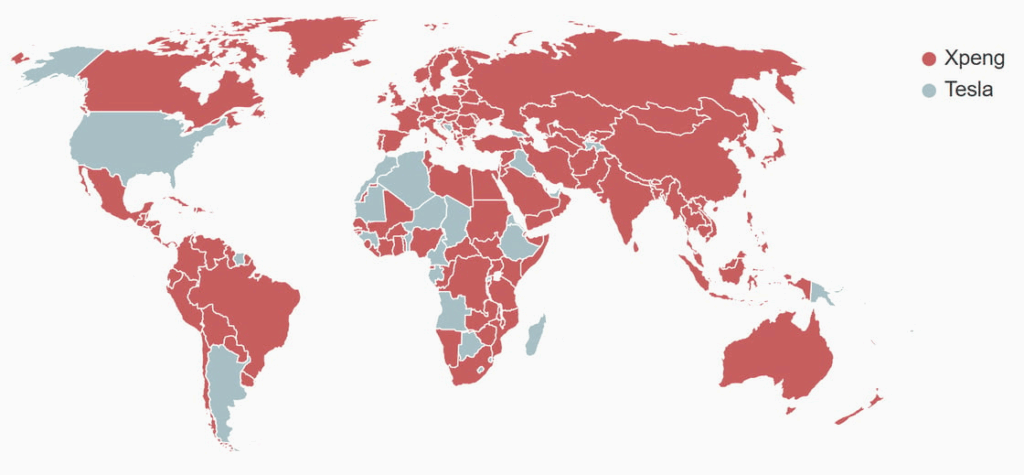

Xpeng Leads Globally, Tesla Holds U.S. Ground

This Atlastic.ai map offers a powerful snapshot of the global EV trust landscape. Xpeng (in red) leads in the majority of countries worldwide, while Tesla (in grey) holds its ground in only a handful of markets.

From Europe and Asia to Latin America and the Middle East, Xpeng is now the most trusted EV brand across a broad global footprint. Tesla, despite a steep global decline in Trust Value, still enjoys relatively strong sentiment in the United States. In fact, the U.S. remains Tesla’s single most positive contributor in terms of trust, remarkable given the wave of controversies surrounding leadership, safety, and public image.

The map reflects the already mentioned larger shift in perception. Chinese EV brands are no longer automatically met with suspicion. Xpeng’s widespread leadership signals a turning point in global sentiment, positioning Chinese manufacturers as credible and preferred in the eyes of both media and the market.

Elon Musk Outshines His Own Companies in Global Media

This media coverage diagram reveals a striking truth: Elon Musk is a larger media brand than both Tesla and SpaceX combined.

Based on Atlastic.ai’s global data, Musk receives more news mentions on his own than either of the companies he leads. His public presence dominates headlines across tech, transport, politics, and innovation.

The overlap between Musk and Tesla is significant. A large portion of Tesla’s media visibility includes direct references to its CEO, underscoring how central he is to the company’s reputation. This linkage also means Tesla’s trust performance is highly exposed to Musk’s public behaviour and statements.

SpaceX, while still a major player in media narratives, has a smaller and more independent footprint. Much of its coverage still overlaps with Musk, highlighting the extent to which even ambitious aerospace ventures remain tethered to his personal brand.

This chart doesn’t just show coverage volume – it visualises the gravitational pull Musk exerts across media narratives and how strongly both Tesla and SpaceX orbit around him.

Atlastic Signals delivers short, high-frequency updates on how companies and markets are perceived in the global media landscape.

Powered by millions of articles in 100+ languages and enriched by proprietary AI models, we surface what the world believes – before it hits the market.

Built for investors, analysts, consultants, and decision-makers who understand that perception drives performance.