Nike dominates the global stage, but Germany’s Adidas and Puma are holding strategic ground in the trust battle. New data reveals how these three giants compare on media-driven perception, geographic dominance, and sentiment resilience – offering valuable signals for investors evaluating brand momentum and volatility.

Trust is a trading signal

In the global sportswear industry, trust isn’t just about reputation, it’s a forward-looking market indicator. Atlastics’ real-time media intelligence tracks and quantifies perceived trust across brands and markets, creating high-frequency inputs into how narratives shape company value. This time, we zoom in on the rivalry between Nike (USA)., the world’s largest sportswear brand by market cap (~$130 billion) and its two historic German challengers, Adidas (~$30 billion) and Puma (~$8 billion), both headquartered in the small Bavarian town of Herzogenaurach.

Born from a family feud and now locked in global competition, these three brands offer a compelling case study in how media sentiment moves markets; region by region, story by story, and spike by spike.

Narrative Overlap: Nike and Adidas dominate global storylines

Media coverage shows Nike and Adidas frequently co-appearing in stories about sustainability, innovation, and high-profile sponsorships, strengthening their narrative dominance. Puma, though with lower volume, aligns closely with Adidas in European markets and performance-focused segments, carving out a targeted narrative position.This overlap pattern, visualized in the diagram, reveals where brands compete for attention – and where one may be gaining ground on another.

Trust ratings and volatility: Puma rises fast, but swings harder

The latest trust rankings as of July 20, 2025, reveal distinct sentiment dynamics among the three major players. Nike holds a Trust Beta of 78 and an A+ S1 A+ trust rating. While its scale drives broad media coverage, it also leaves the brand more vulnerable to global sentiment shifts. Over the past 15 days, Nike’s trust value declined 3.51%, in line with broader macro narratives.

Adidas, with a lower Trust Beta of 20, appears more stable. It maintains the same high-grade trust rating and has seen a 2.32% gain over the same period, suggesting a modest but steady recovery in investor-facing narratives.

Puma, while the smallest in market cap and media volume, has been the most dynamic. With a Trust Beta of just 16, it recorded a sharp 14.33% increase in perceived trust over the past two weeks – despite a notable 8.11% drop the week before. This volatility highlights Puma’s high responsiveness to spikes in media coverage and public sentiment.

For additional context, New Balance, Under Armour, and ASICS all trail these three in both volume and trust stability, with ratings below A and significantly lower media traction globally. This further underscores the leadership position of Nike, Adidas, and Puma – not just in market share, but in media-driven investor perception.

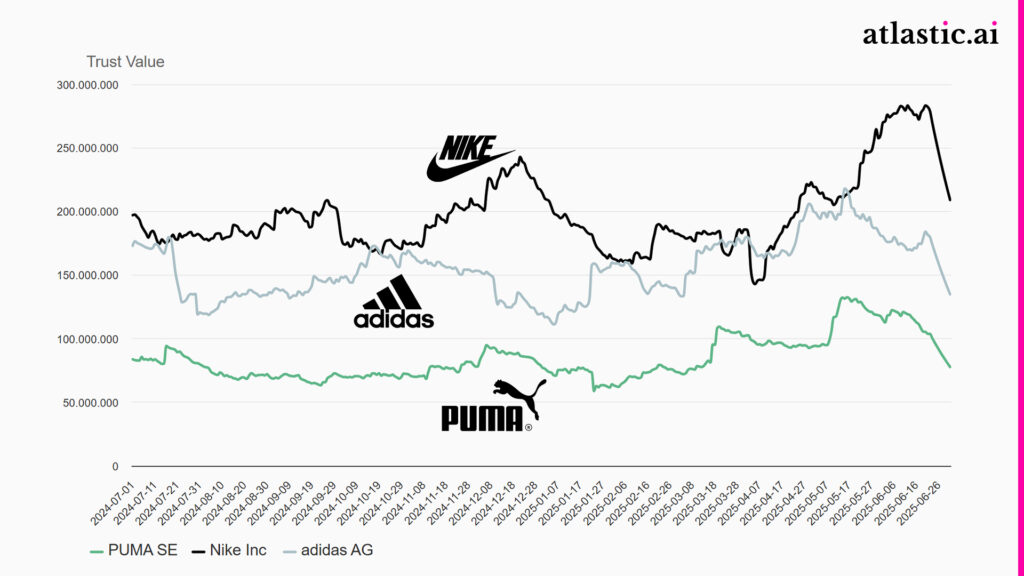

Momentum over time: Nike takes off – Puma surges

The 12-month trust value chart reveals diverging momentum curves that reflect both global brand narratives and localized campaign effects.

Nike maintains a commanding lead, with consistent trust spikes throughout the year – particularly around global athlete partnerships, product drops, and high-profile sponsorships such as the Olympic preparation season, WNBA/NBA-related narratives, and ESG commitments around apparel manufacturing. These events continue to reinforce Nike’s media prominence and brand credibility, though its exposure to global media also creates pronounced volatility when sentiment shifts.

Adidas, by contrast, follows a more stable trajectory. While it has not matched Nike’s peaks, it shows gradual upward momentum, especially in Q1 and early Q2 of 2025 – likely supported by renewed messaging around sustainability, football sponsorships, and regional growth in Latin America and MENA markets. Its perceived steadiness could appeal to investors looking for longer-term brand resilience over short-term hype cycles.

Puma stands out as the most agile mover. Although starting from a lower baseline, it delivers a sharp trust rally between April and June 2025 – suggesting a well-timed activation of regional campaigns, particularly in Africa and Asia-Pacific, as well as increased visibility through partnerships with individual athletes and culturally resonant marketing pushes. Media velocity, not sheer volume, appears to be Puma’s advantage, creating bursts of high-efficiency narrative momentum that attract investor attention.

This momentum profile positions Nike as the scale leader, Adidas as the steady climber, and Puma as the asymmetric opportunity – each with distinct implications for investor sentiment, narrative risk, and short-term trading signals.

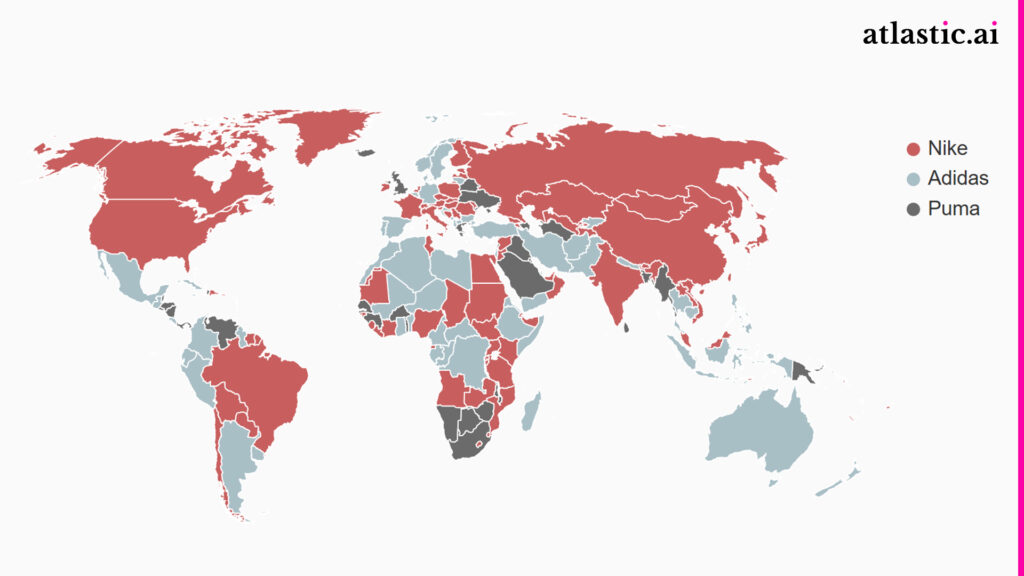

Geographic dominance: Adidas and Puma punch above weight in key markets

Our trust heatmap shows Nike leading across North America, Europe, and Asia, powered by global media scale and sponsorship visibility. But Adidas holds trust leadership across South America, Africa, and the Middle East, where cultural relevance and long-term partnerships strengthen its regional footprint. In Germany, its home market, Adidas maintains a firm media trust position, reflecting both national brand equity and local engagement.

Puma, despite its smaller scale, dominates trust perception in selected countries like South Africa, Iraq, and Papua New Guinea. These pockets of strength suggest the brand is outperforming in overlooked or underweighted regions, potentially leveraging niche positioning and licensing strategy.

Why it matters

In today’s fast-moving markets, media-driven trust isn’t just a branding metric – it’s an actionable signal. Trust reflects how the market perceives a company’s credibility, resilience, and momentum. In sectors like sportswear – where brand value is deeply narrative-driven – shifts in perceived trust often precede market moves.

Atlastics delivers high-frequency, real-time insights into how trust evolves across brands, regions, and sectors – quantifying sentiment dynamics that traditional financial models may miss. These trust signals are used by quantitative hedge funds, equity analysts, and strategic investors to identify inflection points, monitor reputation risk, and uncover mispriced opportunities.

Whether you’re benchmarking portfolio holdings, scouting for sentiment-driven trades, or stress-testing narrative exposure, Atlastics enables you to turn perception into positioning.

Thanks for reading. We’ll be back soon with more curated insights. In the meantime, you can explore the full live dataset at atlastic.ai for deeper analysis and real-time trust metrics.

Atlastic Signals delivers short, high-frequency updates on how companies and markets are perceived in the global media landscape.

Powered by millions of articles in 100+ languages and enriched by proprietary AI models, we surface what the world believes – before it hits the market.

Built for investors, analysts, consultants, and decision-makers who understand that perception drives performance.