As part of our latest industry analysis at Atlastic.ai, we’ve taken a closer look at publicly listed pharmaceutical companies – focusing on how the world’s most influential drugmakers are perceived across global media.

Leveraging our real-time media analytics engine, we’ve tracked Corporate Trust Values to uncover how trust shifts across markets, what drives reputational volatility, and which companies consistently maintain strong public perception – and why.

This edition puts particular focus on the rising rivalry between Eli Lilly and Novo Nordisk, as reflected in media narratives, brand mentions, and public sentiment. We’ll explore how their respective GLP-1 brands are shaping the conversation – and the market.

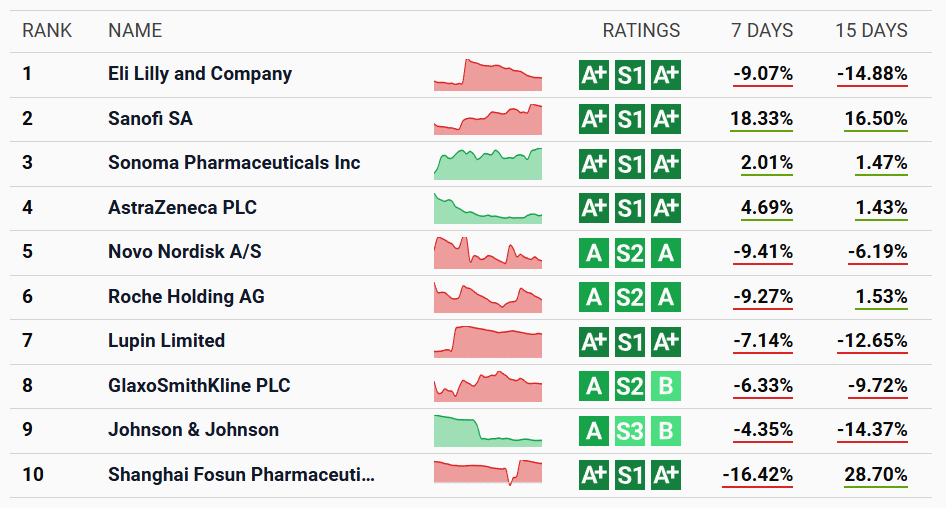

Top 10 Pharma Stocks by Trust Value

Ranked by media-driven trust and short-term sentiment trends, this week’s list highlights shifting perceptions in the pharma sector.

Eli Lilly retains the top spot despite a cooling trend, while Sanofi and Bristol-Myers Squibb show breakout trust momentum. Novo Nordisk sees a sharp dip -raising questions of overreaction or early warning. Meanwhile, Amgen surges with the strongest sentiment gains.

Watch for reversals, new catalysts, and trust-driven market signals across this evolving landscape.

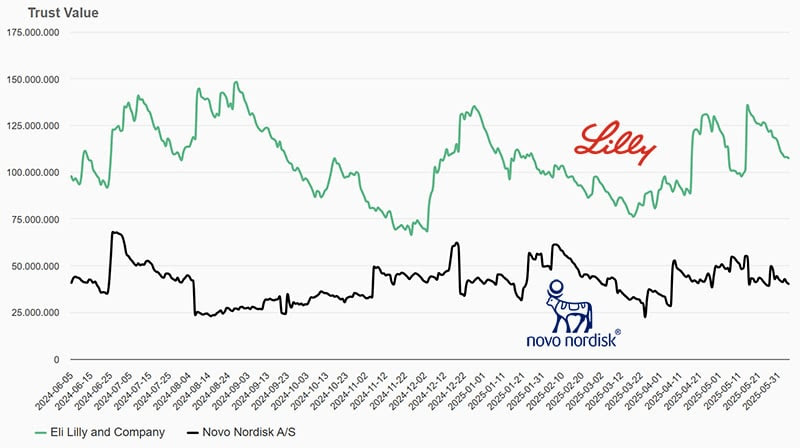

Rival Watch: Eli Lilly vs. Novo Nordisk

Two titans in diabetes and obesity treatment, both highly trusted – but media sentiment now diverges. This chart compares the media-based Trust Value trends of Eli Lilly, Novo Nordisk, and the broader drug manufacturing sector from June 2024 to June 2025.

Eli Lilly consistently leads in trust but shows high volatility, with several sharp drops and rebounds – reflecting how strongly it’s affected by media sentiment shifts, especially around its weight-loss and diabetes treatments.

Novo Nordisk displays a more erratic and generally lower trust trend, with notable dips and only partial recoveries. Its trust performance remains below both Eli Lilly and the industry average for most of the period.

The overall drug manufacturing sector shows the most stable trajectory, gradually improving over time. This highlights how individual companies can swing sharply on media cycles, while the sector as a whole maintains steadier sentiment.

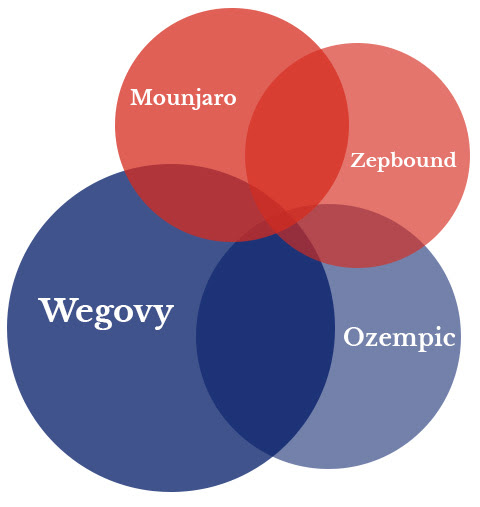

GLP-1 Rivalry in the Media

The media narrative around GLP-1 drugs is shaped by four dominant brands: Wegovy, Ozempic, Mounjaro, and Zepbound. In the chart, the size of each circle reflects the total amount of media coverage, while overlapping areas indicate how often brands are mentioned together in the same news stories.

Novo Nordisk’s Wegovy receives the most attention, frequently appearing alongside Ozempic, which reinforces the company’s leading role in the weight-loss and diabetes conversation.

Mounjaro, from Eli Lilly, also features prominently – often in direct comparison with Wegovy -highlighting the growing rivalry between the two companies. Zepbound, Lilly’s newer entrant, garners slightly less media focus but appears regularly in overlapping coverage with both Mounjaro and Wegovy, signaling its emerging relevance.

Overall, Novo Nordisk leads in visibility, while Eli Lilly is gaining ground – especially in stories centered on competition and market dynamics. The structure of media mentions reflects not just brand awareness, but how tightly these products are linked in public discourse.

Thanks for reading! Want more insights on how perception shapes the global market? Follow Atlastic on LinkedIn

Atlastic Signals delivers short, high-frequency updates on how companies and markets are perceived in the global media landscape.

Powered by millions of articles in 100+ languages and enriched by proprietary AI models, we surface what the world believes – before it hits the market.

Built for investors, analysts, consultants, and decision-makers who understand that perception drives performance.