For Quants

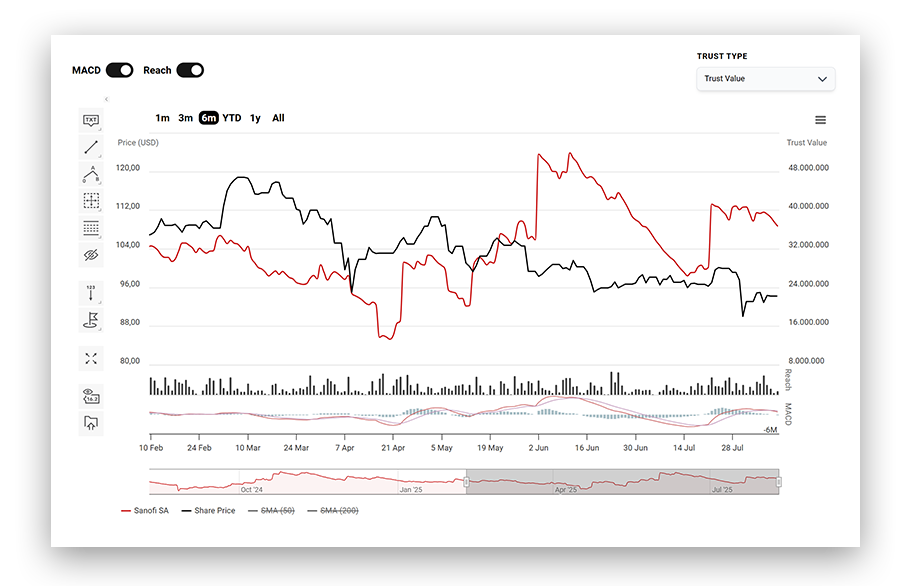

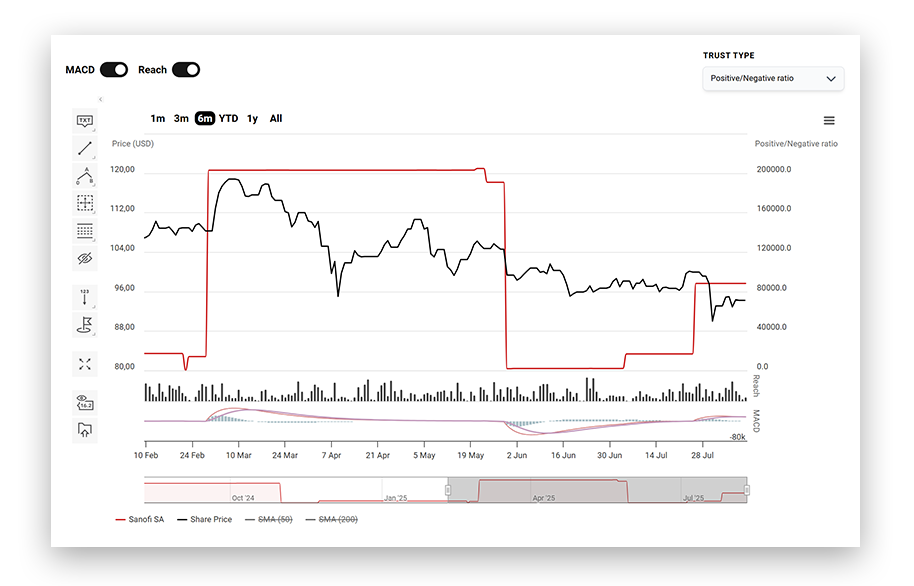

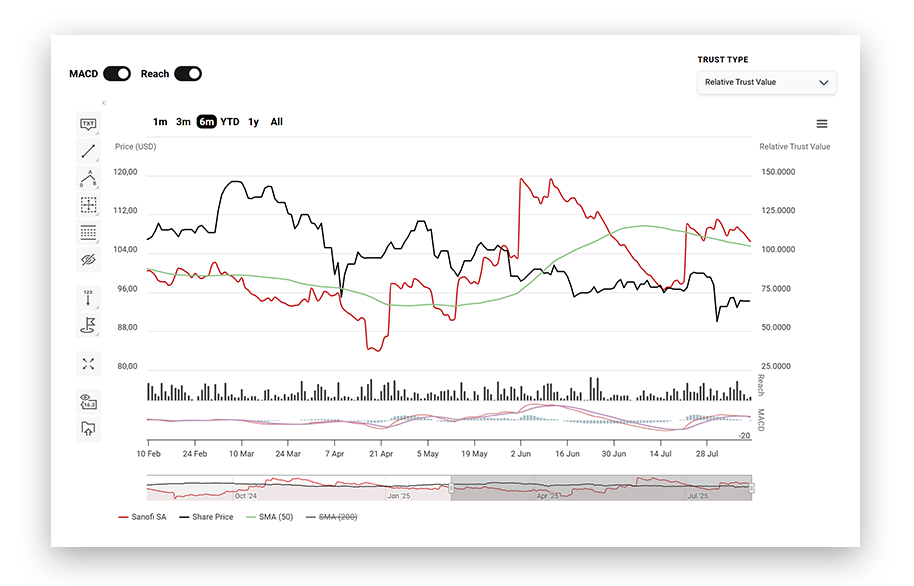

News shapes trust. Trust moves markets. Atlastic tracks how global news impacts corporate trust (the major goodwill driver) – and share prices.

Perception as Alpha — For the Win

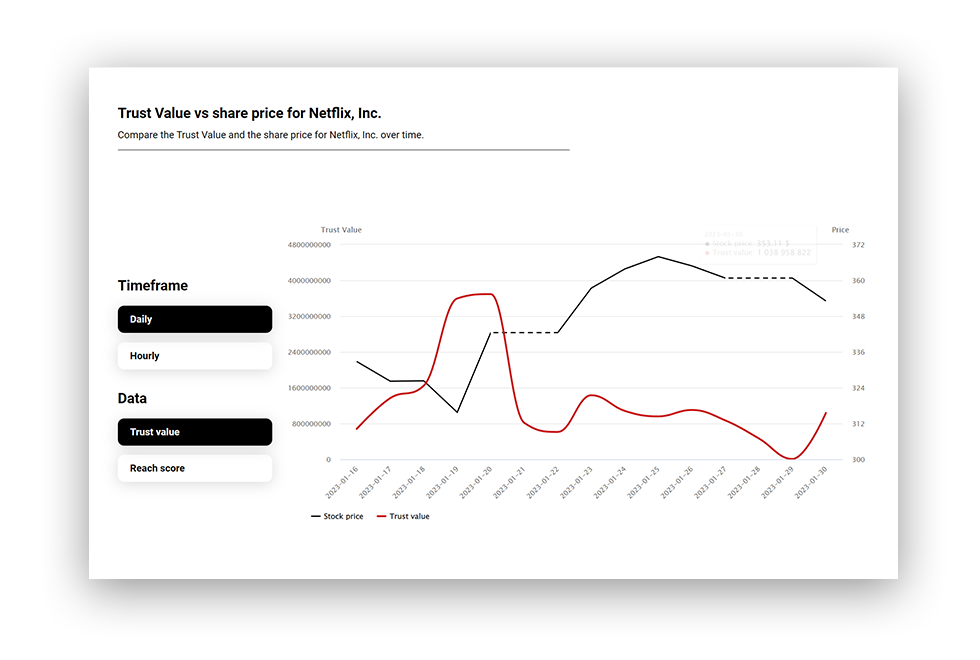

Unlock untapped alpha from public narratives, media shifts, and perception swings across millions of global sources. Trust is not a soft metric—it is a forward-looking signal. Corporate reputation, as reflected in news media, increasingly drives valuation, risk exposure, and long-term performance.

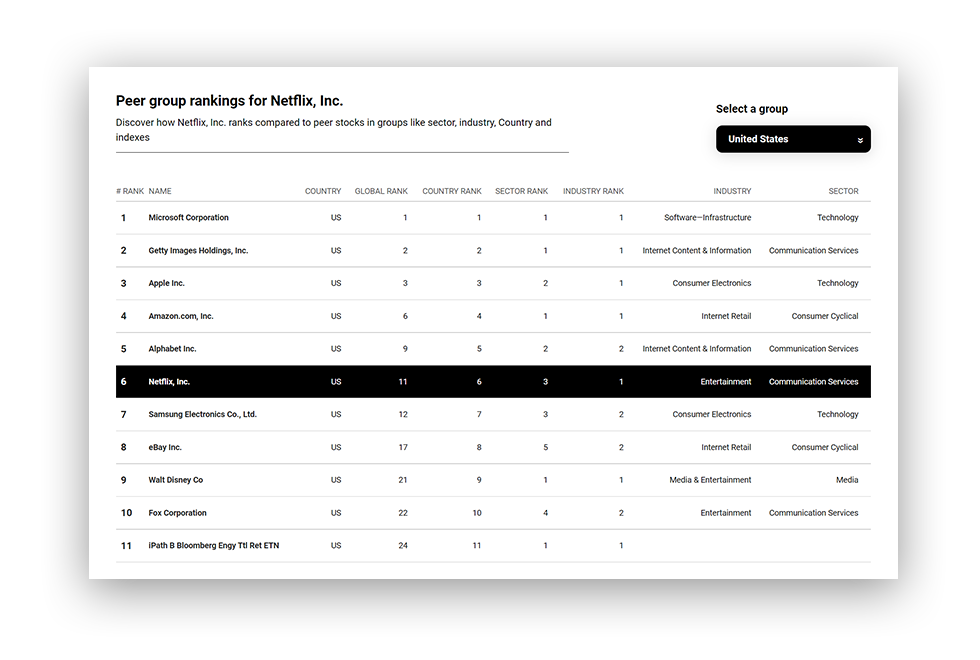

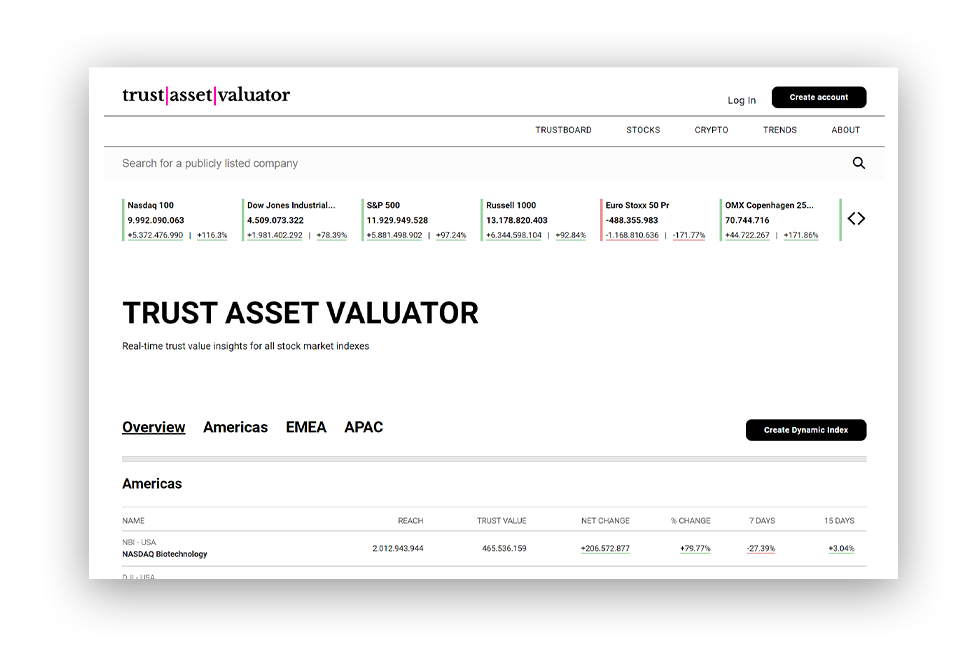

Atlastic’s live Trust Value rankings deliver a real-time view of how companies are perceived worldwide, powered by millions of verified news signals across 100+ languages.

Relevance from Perception

Today, 84% of market value is intangible, with corporate trust and reputation as its primary drivers. Who can afford not to be informed? Traditional sentiment data is too one-dimensional—capturing tone but not the impact of sentiment. Add the limits of low-frequency surveys, pre-defined questions, and narrow respondent pools, and the picture is incomplete.

The media landscape runs on attention—and attention is a proxy for beliefs, needs, values, and emotions. These forces shape perception, influence decision-making, and ultimately move markets. Atlastic decodes this complexity, transforming it into structured, scalable, and predictive data—ready to plug directly into quant and fundamental workflows.

Precision methodology. Proven data

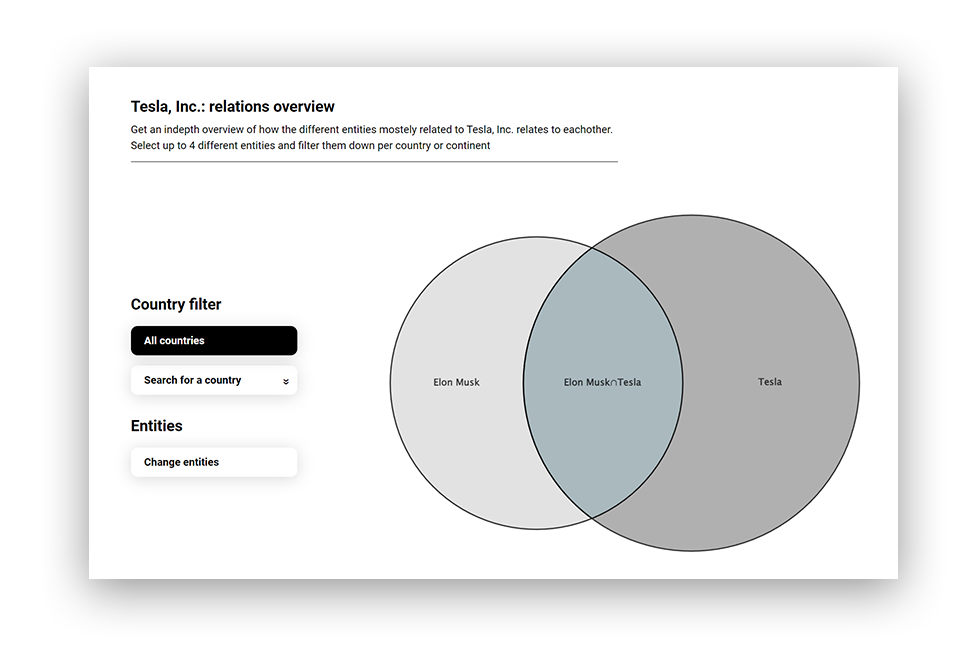

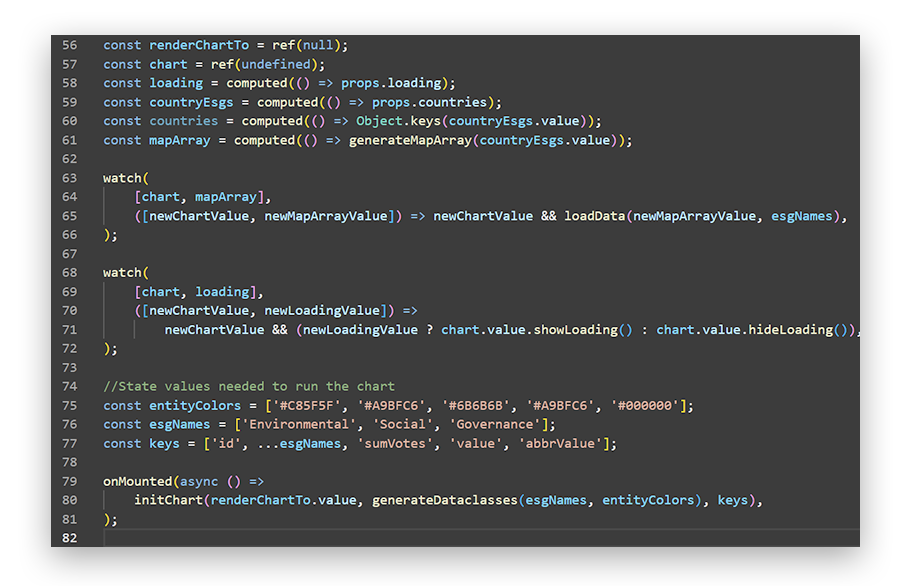

Atlastic is built for quant teams, delivering clean, structured media perception data to uncover narrative patterns, test hypotheses, and build proprietary signals at scale. With full analytical flexibility, users can quantify narrative momentum, link shifts in trust and perception to market outcomes, and backtest signals across time and entities.

Atlastic ingests 4M+ articles daily from 8.2M verified sources across 100+ languages and 250+ jurisdictions. The dataset spans financial media, industry publications, regulatory filings, NGO reports, and both local and global news.

Unlike keyword-based sentiment tools, Atlastic is designed for context and precision. It captures narrative framing through contextual scoring, source influence weighting, multilingual and cross-market bias control, a clear separation of sentiment and visibility, and time-aware tracking of perception shifts.

- Detect narrative build-up before volatility events

- Track trust, reputation, risk, and controversy signals globally

- Feed perception-based inputs into trading models, factor research, and thematic strategies

- Structured perception data (API or data feed), ticker-mapped and time-stamped

- Historical datasets for signal backtesting

- Real-time alerts based on thresholds, entities, or topics

- 50.000 tickers (all stocks globally)

Seamless Delivery

Atlastic data is fully structured for time-series analysis, topic and entity mapping, hypothesis testing, and cross-asset comparison. From targeted datasets to full-universe coverage, integration is seamless.

Data is delivered in clean, machine-readable formats—via API or custom feeds—ready to plug directly into models, systems, and analytical workflows. Built for scale. Designed for precision. Engineered for discovery.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.