For Asset management

Perception intelligence, delivered simply.

No code. No quant team required.

Win with Trust

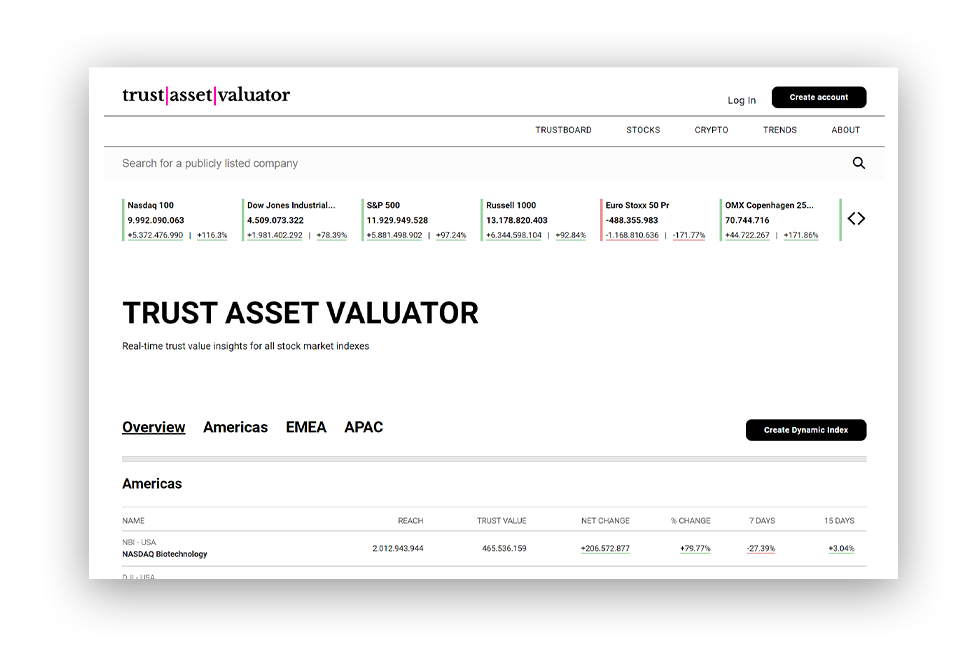

Capture hidden signals before they appear in traditional data. Portfolio performance increasingly depends on more than fundamentals and financial disclosures. Public narratives, shifting media sentiment, and emerging trust signals are now critical drivers of capital flows, risk exposure, and long-term valuation.

Atlastic transforms millions of verified news signals into structured, predictive data—enabling asset managers to anticipate reputational shifts, sentiment swings, and sector-wide narrative momentum before they move markets.

The Relevance of Perception

Today, 84% of market value is intangible, with trust, reputation, and stakeholder perception shaping investor behavior and price formation. Yet traditional sentiment analysis is too shallow, capturing tone but not impact. Surveys lag real-time events and fail to reflect the full complexity of market narratives.

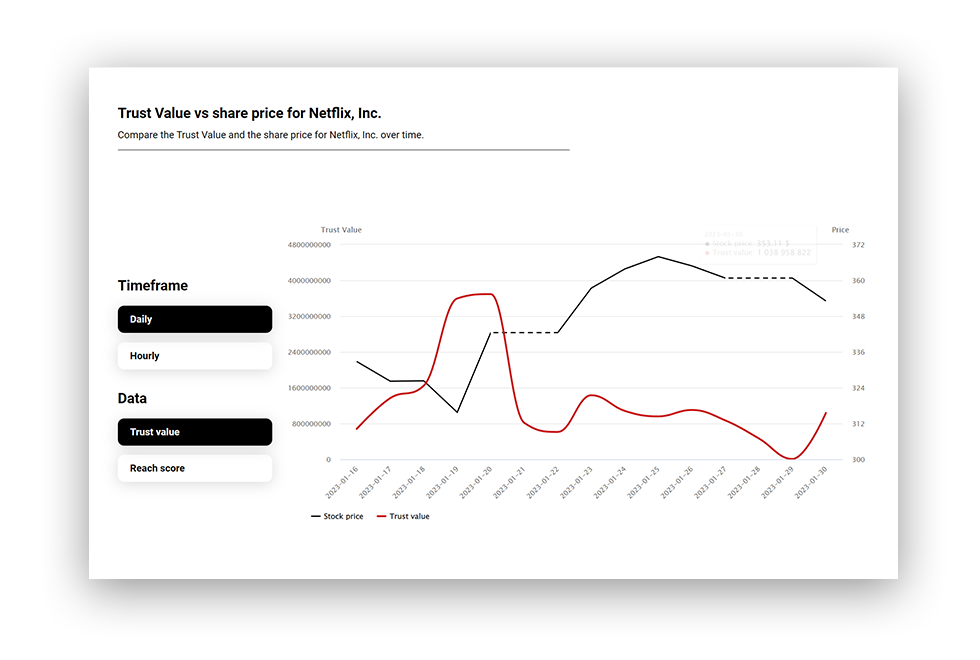

The media ecosystem runs on attention, and attention mirrors beliefs, values, and emotions, the very forces that drive buy, sell, and hold decisions. Atlastic decodes this relevance, transforming narratives into structured, real-time data that gives asset managers a clear view of market perception – enabling sharper portfolio allocation, proactive risk management, and new sources of alpha.

A Methodology Beyond Sentiment

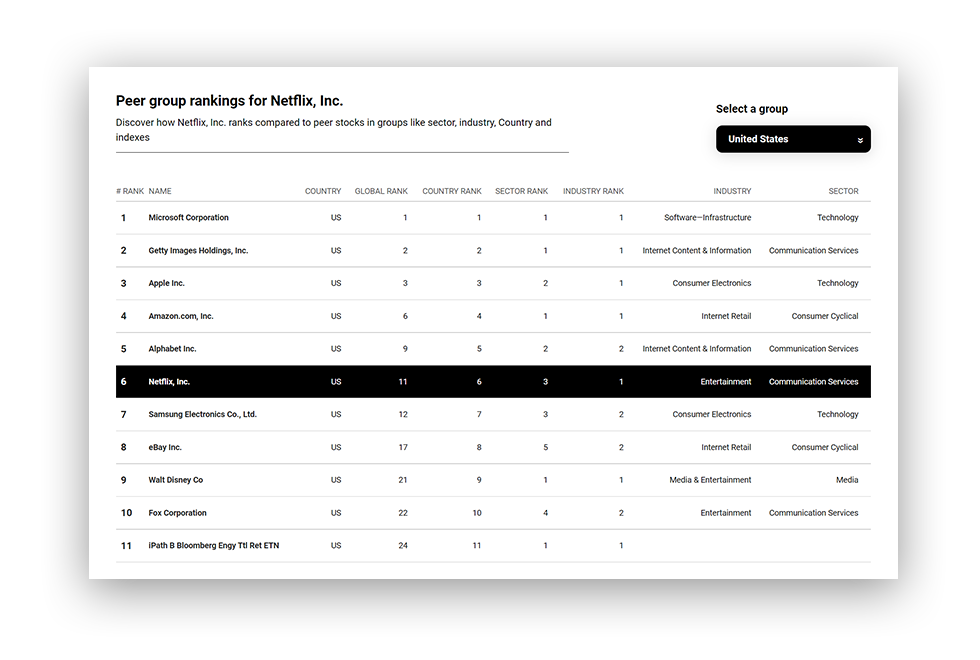

Atlastic is built to give asset managers a structured, scalable view of market perception – engineered for analytical precision and investment decision-making.

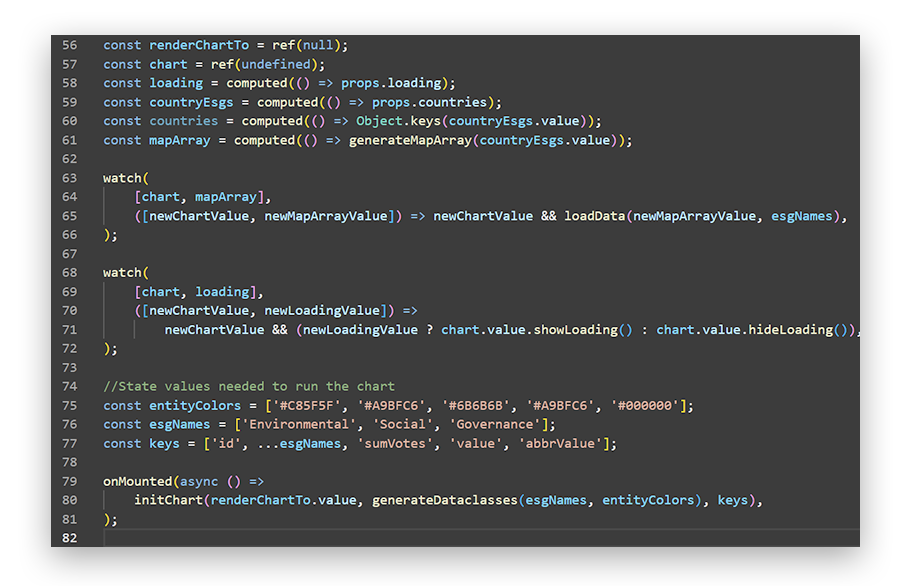

Our pipeline ingests over 4 million articles daily from 8.2 million curated, verified sources across 100+ languages and 250+ jurisdictions. Coverage spans financial media, industry publications, regulatory filings, NGO reports, and local as well as international news. Each signal is contextually scored, source-weighted, and time-stamped, producing a reliable, repeatable dataset for strategy building and risk management.

Unlike traditional sentiment tools that simply count positive or negative words, Atlastic applies a methodology designed to capture context, impact, and momentum. With this foundation, asset managers can test hypotheses, build proprietary factors, backtest signals, and integrate narrative-driven data into both quant and discretionary strategies. The result: a differentiated alpha layer that identifies perception risks and opportunities before they move price.

And while the data is research-grade, the solution is accessible through an easy-to-use, no-code platform—so advanced perception intelligence can be deployed without a quant team.

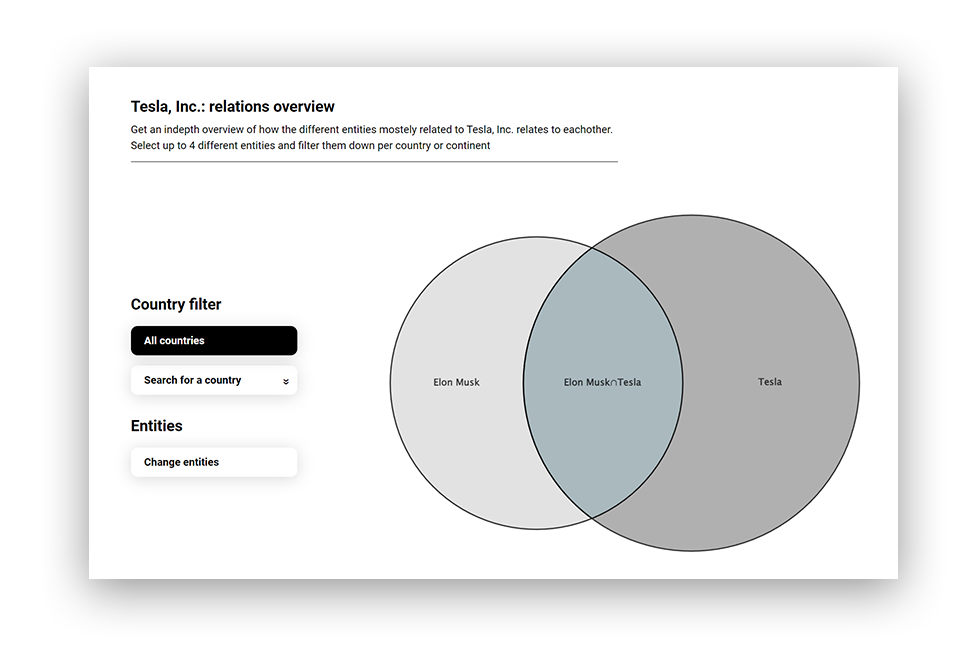

- Narrative intelligence: Detect and quantify how stories about companies, sectors, and themes gain or lose traction over time

- Context-aware scoring: Capture meaning and framing, not just tone

- Source influence modeling: Differentiate between a major publication driving market attention and low-impact chatter

- Bias control: Adjust for geographic, linguistic, and market biases to avoid skewed readings

- Separation of visibility and sentiment: Track both narrative volume and directional perception shifts

- Time-aware tracking: Map narrative build-up and decay to market movements for true predictive power

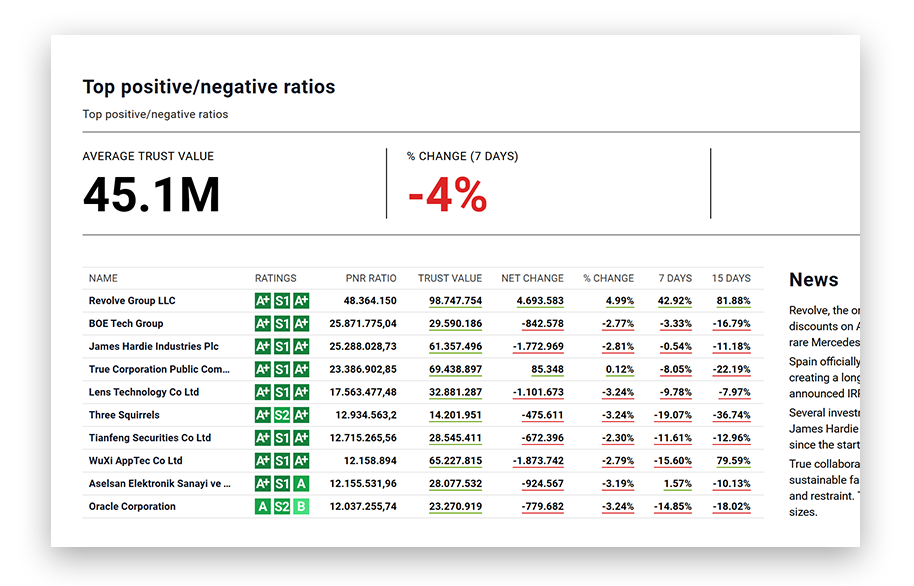

Precision Data Delivery

Atlastic data is fully structured for time-series analysis, hypothesis testing, and cross-asset comparison. Whether portfolio-wide coverage or targeted datasets are needed, integration into existing infrastructure is seamless.

Delivery is available in two ways:

- Direct integration via API or custom feeds – clean, machine-readable, and ready for models, systems, and analytical workflows.

- An easy-to-use, no-code platform – making advanced perception intelligence accessible without a quant team.

Built for scale. Designed for precision. Engineered for discovery.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.