Trading signals

Actionable Media-Derived Insights for Investment Teams

Win with Perception-Driven Trading Signals

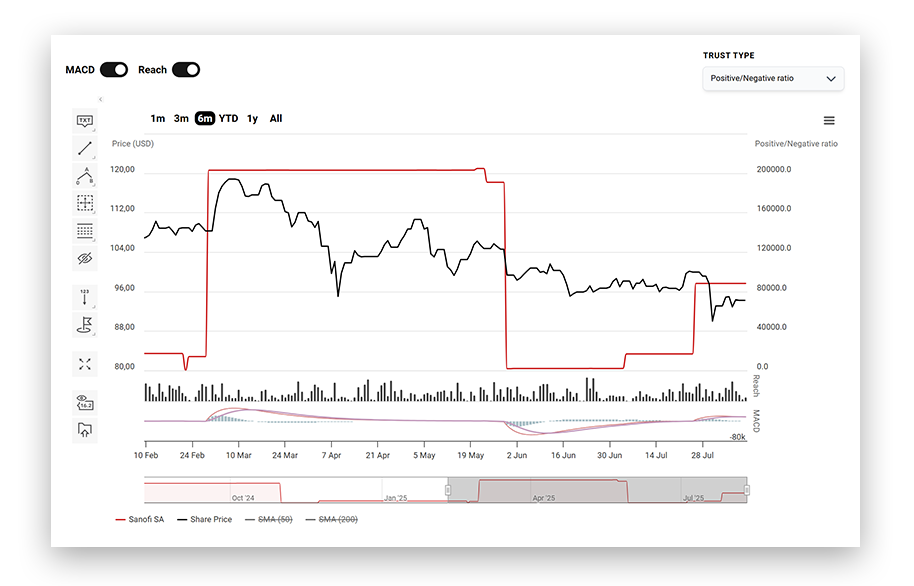

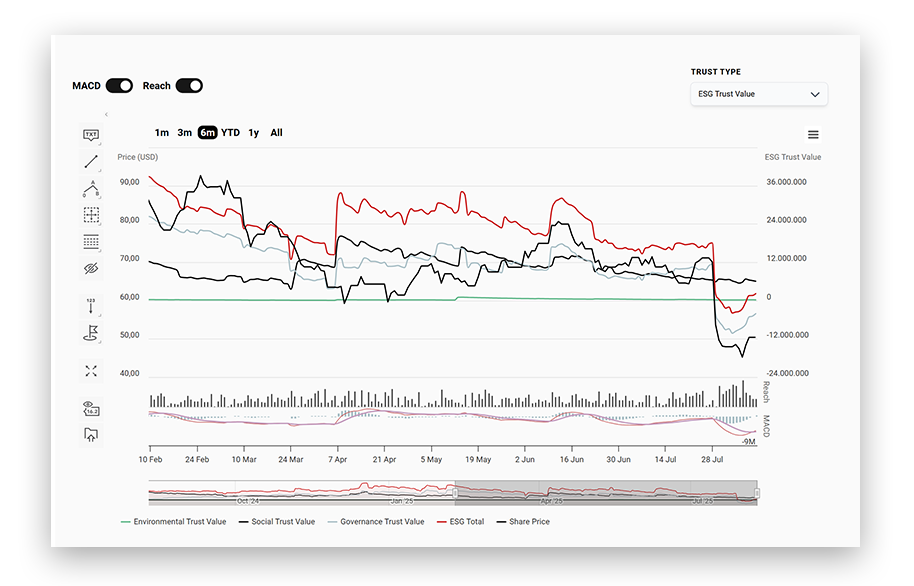

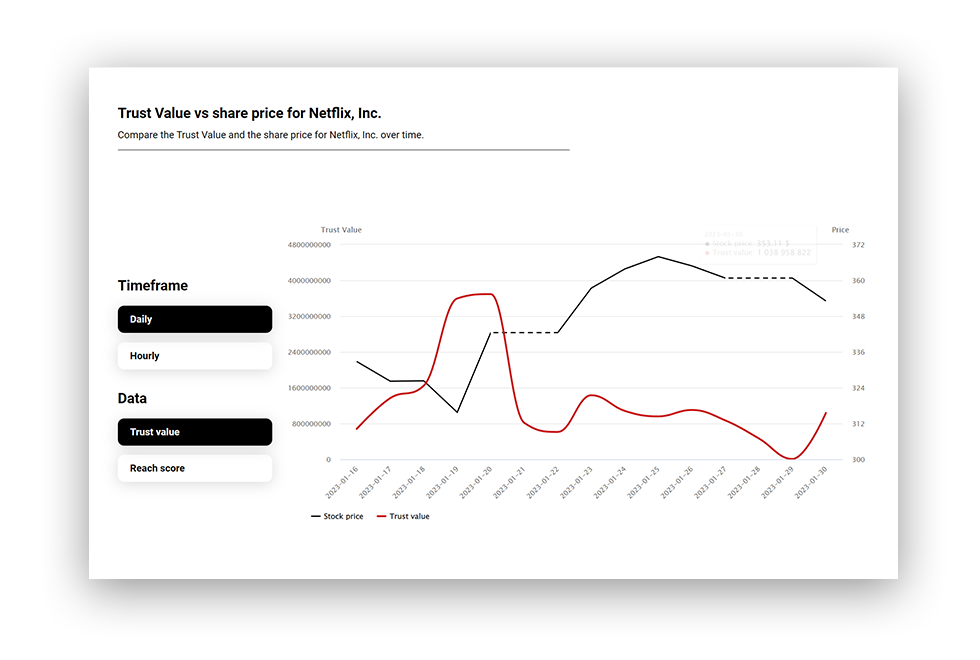

Markets move on perception before fundamentals adjust. Sentiment shifts, trust dynamics, and narrative momentum redirect capital flows long before earnings reports or analyst ratings catch up. But most investment teams still lack structured, high-frequency perception data to act on these signals in real time.

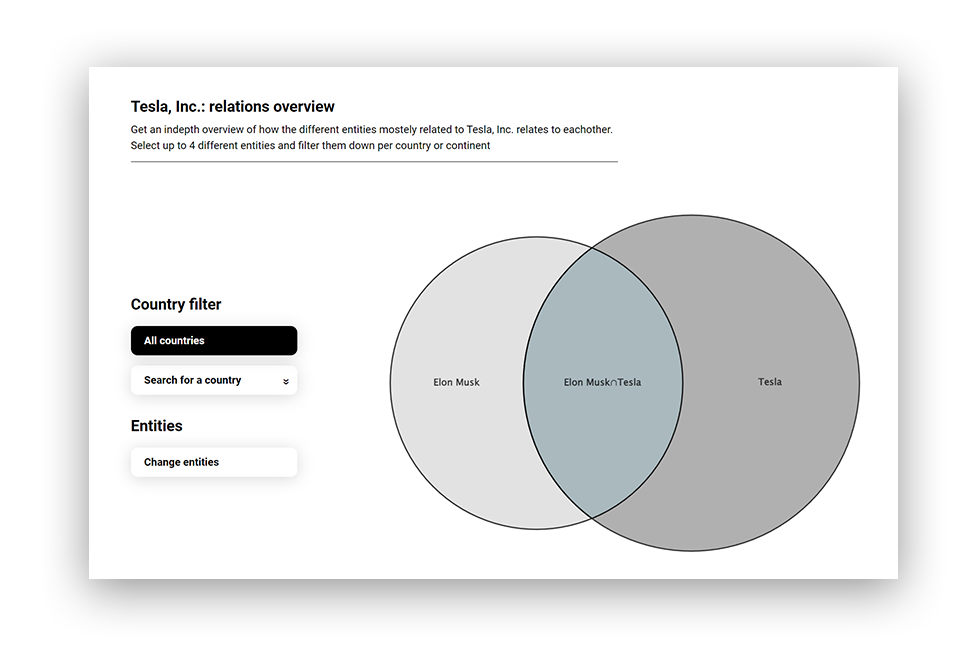

Atlastic closes this gap by delivering ready-to-use trading signals from millions of verified global media sources, mapped to 50,000+ listed companies. Purpose-built for portfolio managers, analysts, and investment teams, these signals provide clear, actionable inputs—without the need for a full quant research infrastructure.

The Relevance of Perception in Trading Alpha

Markets move on perception before fundamentals adjust. Media narratives and public confidence influence valuations, governance issues and controversies often surface early in the press, and shifts in trust can fuel rallies—or trigger sell-offs.

Traditional sentiment tools lag, rely on keywords, or demand manual interpretation. Atlastic solves this by transforming global media into structured, trade-ready signals, enabling investment teams to react faster and with greater conviction.

Atlastic Trading Signals provide:

- Actionable indicators – buy/sell/watch signals based on aggregated perception shifts.

- Narrative intensity alerts – flagging stories likely to move markets.

- Trust momentum & controversy risk – tracking confidence gains or early signs of reputational shocks.

Data at scale: 8.2M global sources, 4M+ new articles daily, processed across 100+ languages with 5+ years of point-in-time history for validation.

The Difference Perception Data Makes for Investment Teams

- Tactical trading – capture short-term alpha from perception-driven price shifts.

- Event monitoring – stay ahead of news likely to impact holdings.

- Portfolio protection – detect controversy build-up early to de-risk positions.

- Idea generation – uncover companies with rising trust momentum before analyst upgrades.

Data Delivery

- Direct API & Alerts – ready-to-use trading signals for immediate action.

- Custom Dashboards – portfolio-level monitoring with real-time decision support.

- Historical Feeds – point-in-time data to validate performance and refine strategies.

Atlastic delivers structured, media-derived trading signals built for non-quant investment teams—making perception a practical, tradable dimension of market intelligence.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.